by Moe Bedard | Nov 5, 2021 | Foreclosure News |

Property analytics firm, ATTOM recently reported more than 1.3 million ‘zombie’ homes in the US. The definition of a ‘zombie’ property is a home abandoned by homeowners who have defaulted on their mortgage due to a pending foreclosure and remains vacant, while the title remains in their name along with all financial responsibilities.

According to the report, approximately 1,312,410 homes sit vacant and are in foreclosure status across the country, which represents one in 75 residential properties or 1.3% of the housing market.

New York state reported the highest number of zombie properties in the US” with 2,049, followed by Ohio with 925 and Florida reported 907 vacant homes.

The analytic firm warned “the foreclosure scenario stands at a precipice”, with the number of zombie properties “likely to increase over the coming year. That’s because lenders can resume taking back properties from homeowners who fell far behind on loan payments during the pandemic, following the recent end of a 15-month foreclosure moratorium that affected most mortgage payers.”

Chief product officer of ATTOM, Todd Teta, said: “Zombie foreclosures are in a holding pattern this quarter – at least for now. They’re still totally off the radar screen in most parts of the country, with none in most neighborhoods. But that’s probably going to change soon because lenders can now return to court and take back properties from owners who can’t keep up on their mortgage payments. Foreclosure activity is already on the upswing. So, depending on how fast cases wind through the courts, it’s probably just a matter of time before zombie properties begin creeping back into the mix.”

The number of properties that have been abandoned by homeowners decreased slightly from 3.5% in the third quarter of 2021 to 3.3% in the fourth quarter.

The report stated, “Just one of every 13,292 homes in the fourth quarter are vacant and in foreclosure, down from one in 13,060 in the third quarter of 2021 and one in 13,074 in the fourth quarter of last year.”

According to ATOM, much of that will depend on how many delinquent homeowners will be able to work out repayment plans.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Nov 5, 2021 | Foreclosure News |

YouTubers Austin and Catherine McBroom Woodland Hills home was recently foreclosed upon by their lender, 5 Arch Funding Corporation, for failing to make payments on their $8.7 million mortgage.

The celebrity influencers were served with a notice of default in May 2021, and the home was sold on October 19 at a foreclosure auction.

The McBrooms falsely denied rumors on social media that they could be evicted from their house. “Ain’t nobody getting evicted, ain’t nobody moving,” Austin stated on Instagram in July.

The couple had used the home to showcase their lavish lifestyle on their ACE Family YouTube channel with over 19 million subscribers but have been embattled with lawsuits and rumors that they are in dire financial straits due to bad business decisions.

Austin and Catherine McBroom purchased the 12,000-square-foot home one year after it was built in 2019 for $10.1 million in 2019.

They remain in the foreclosed property with their three children until their lender files an eviction lawsuit, which is the next step in the legal process to have them leave the home.

The couple also has many other legal problems and is involved in several lawsuits. Austin McBroom was sued for $100 million by LiveXLive for allegedly failing to meet contract obligation related to a social media star boxing event, “Social Gloves: Battle of the Platforms.”

Investors were allegedly promised they would make $200 to $500 million in profit as a return on their investment, but instead, it was a failure, and they incurred substantial losses.

Catherine McBroom is being sued by TBL Cosmetics, a “premium skincare line” with ethically sourced ingredients. According to the lawsuit papers filed in court, Catherine was supposed to promote the company on social media, but TBL said she “conspired with her family, friends, and other under-utilized members or idle of her entourage to stage a takeover of 1212 Gateway’s management,” or effectively enact a “coup” against TBL.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Oct 3, 2021 | Mortgage News from LoanSafe.org |

The Rich Dad Poor Dad author, Robert Kiyosaki has been in the news lately for saying that a major crash is coming to the real estate market and the stock market due to the debt crisis of China’s largest property developer, the Evergrande Group.

The Chinese developer owes $300 billion in outstanding loans, and their property portfolio looks overvalued to him.

In a Tweet last week, he told his 1.7 million Twitter followers that he expects a massive crash in the near future.

“HOUSE of CARDs coming down. Real estate crashing with the stock market,” Kiyosaki tweeted. “China’s Evergrande Group cannot pay. Valuation of properties fake. Will real estate crash spread to US? Yes,” he said.

“Stocks dangerous. Careful,” he warned in the tweet.

“Giant stock market crash coming October. Why? Treasury and Fed short of T-bills,” said Kiyosaki.

“Gold, silver, Bitcoin may crash too. Cash best for picking up bargains after crash,” he added.

He also told Kitco News last week that this “is going to be the biggest crash in world history.

Kiyosaki has been sounding the alarm for several months now like in June when he tweeted;

“Biggest bubble in world history getting bigger. Biggest crash in the world history coming.”

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Oct 3, 2021 | Mortgage Help |

If you are unable to pay your mortgage, refinance, or get a loan modification, you may be able to qualify for what is called a “deed in lieu of foreclosure.”

A deed in lieu of foreclosure (DIL) is a legal procedure in which you willingly transfer your property’s title (deed) back to the lender.

In return, the lender agrees to release you from all legal obligations to the mortgage contract. This will be done to satisfy a defaulted loan and to prevent foreclosure proceedings.

A DIL is often better than just walking away from your home and letting it fall into foreclosure because it has a less detrimental effect on your credit score.

You can also negotiate with your lender so that they will not legally come after you to collect any money you may owe on the mortgage in back payments and fees after the lender has sold the property.

On the other hand, a deed in lieu is also beneficial for the lender because it avoids the costs and effort required for a foreclosure sale.

What are the elegibility requirements?

You may qualify for a DIL but let me warn you that this is not an easy process. Before your mortgage servicer even considers this option, you must meet specific elegilibility requirements;

- You cannot afford your current monthly mortgage payments

- The property must be your primary residence, not an abandoned or investment property.

- You’re experiencing financial hardship, such as losing your job, reduced income, significant illness, divorce, or another difficulty.

- You’re unable to obtain a loan modification and have exhausted all other loan workout options and financial resources available to you.

- You tried to sell your property with a licensed real estate brokerage at fair market value for at least 90-120 days but were unsuccessful

- You don’t wish to stay in your house due to other circumstances, such as a job relocation

- You must have actively explored and exhausted all other options and financial resources available to you.

How do I get a deed in lieu of foreclosure from my lender?

In general, a deed is a right granted by a legal contract based upon mutual agreement; therefore, a deed-in-lieu must be based upon voluntary agreement in good faith.

To proceed with a deed in lieu, both parties must agree to and sign both an Agreement in Lieu of Foreclosure, which outlines the terms of the deed and the deed itself, which transfers legal ownership of the property.

For the agreement to be reached, the property’s appraised market value must be less than the original agreement’s outstanding debt, and the property must not be subject to any 3rd party creditor claims or liens.

A third party escrow service then executes the legal agreement, which will release both you and the lender from the original contract.

Once the agreements are reached and there a clear title, the lender then classifies the original loan as paid and issues a waiver to a deficiency judgment. This will typically go into effect if the property’s sale results in less than what is owed on the debt.

Please be advised that many lenders may not be amenable to a deed in lieu because they believe they will have a better title after a standard foreclosure sale. This is because a trustee’s deed of sale effectively erases any judgment liens and second and third mortgages after a foreclosure. Thus, it would depend on the borrower’s lender whether they will accept a deed in lieu or not.

How will it affect my credit?

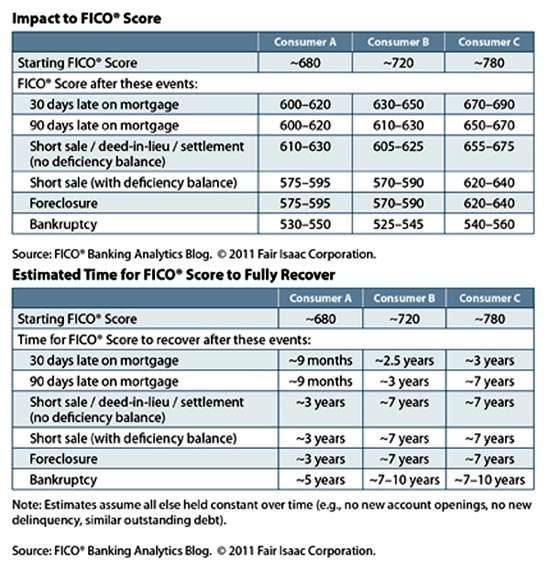

A deed in lieu of foreclosure will cause a negative impact on your credit score. According to a 2011 FICO study, if you begin with a score of approximately 720, it will drop 105 to 125 points off your score; but if you start with a score of 680, you’ll lose 50 to 70 points. But please be aware that your score will drop a lot more if there is any deficiency balance owed.

Here are the charts from FICO;

With that said, you can expect to lose from 50 points minimum to 250 or more points depending on your credit score when you started and if you own a deficiency balance or not. The credit report will also reflect the deed in lieu for seven years, although a borrower can still rebuild their credit.

However, the ill effect on the credit score gradually lessens in time, and you may request its removal from a credit report towards the closing of year seven.

Tax Consequences

Please be aware that if you can complete a deed in lieu of foreclosure, you will still be liable for taxation on the cancellation of indebtedness or COD income. The tax results would be based on whether the loan is classified as a non-recourse loan or a recourse loan.

You can find out if your loan is recourse or non-recourse in your original loan documents that were initially signed by the lender and borrower.

A, if the basic rule of thumb is that if a lender’s only option is to take possession of the property when the borrower defaults, it is a non-recourse loan. However, if the lender can go after the borrower to collect any shortfall when the property is sold, then it is a recourse loan.

A lender will submit a Form 1099-C to the IRS in the case of a shortfall. This is known as the borrower’s COD income.

In the case of a non-recourse loan, the IRS will consider the deed’s tax consequences in lieu as if the borrower had sold the property. If the property’s current market value is less than what is owed, the borrower will have a personal loss, but this is not tax-deductible.

On the other hand, if the property’s value is greater than the outstanding loan, the borrower will have a gain that may not be taxed if he is able to comply with IRS Sec. 121 two-year residency requirement. In the case of a recourse loan, the situation is similar to the non-recourse loan except that the borrower will also be taxed for COD income if the property’s value is less than what is owed. Ordinary income rates will be applied for the COD income.

According to the IRS, the amount of the benefit must be reported as income received under IRC §61(a)(11)3, unless the taxpayer qualifies for an income exclusion under IRC §108.

When can I buy another home?

Most lenders will not offer a loan to a borrower who has filed a deed in lieu for a minimum of two to three years since it will significantly bring down your credit score. The chances of loan approval increase after a few years, especially if a borrower attempts to rebuild their credit score.

But please be aware that some alternative lenders may extend a mortgage to borrowers who maintain good credit score (680 and above) with large down payments in the 25-30% range.

Generally speaking, you will have to wait after a few years as passed and new credit has been established to purchase a home once more.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Oct 3, 2021 | Mortgage Help |

The CARES Act was designed to help struggling homeowners during the COVID pandemic by offering mortgage forbearance options. Millions of homeowners took advantage and didn’t have to pay their mortgage for three months or longer, depending on the lender.

Now that the forbearance period has ended, many homeowners still need help. If you have a mortgage owned by Freddie Mac or Fannie Mae, you may be eligible for a Flex Loan Modification.

Please keep reading to learn what it’s all about.

How to Get a Flex Loan Modification

Any borrower who is 60 days or more past due on their mortgage or in an imminent default risk may be eligible for the Flex Loan Modification. This new program replaced the previous Home Affordable Modification Program and is only for borrowers with a Freddie Mac or Fannie Mae Loan.

To qualify, you must meet the following:

- You’re experiencing an eligible hardship that affects your ability to pay your mortgage

- You don’t have enough money to cover the mortgage payment and taxes/insurance as it stands

- You have a stable income that allows you to pay the modified mortgage

- You must have originated the mortgage at least 12 months before the request for a loan modification

- You aren’t eligible for a refinance or relief refinance based on your financial situation

- A relief option, such as breaking up the past due amount over a series of months, isn’t feasible

The loan also must not be in the middle of any assistance or recourse, including any workout options, forbearance plans, or active trial plans.

You also must not have modified the mortgage more than 3 times in the past or have failed a past trial period within the last 12 months.

If you’re eligible, you must provide all documentation for a Borrower Response Package, including:

- A completed and signed Uniform Borrower Assistance Form

- Documentation of your hardship

- Proof of income to show that you can afford the loan

Some borrowers may be eligible for a streamlined program if they:

- Are more than 90 days past due and in imminent danger of foreclosure

- Have a step-rate mortgage and become 60 days or more past due within the first 12 months of the interest rate change date

If you’re eligible for a streamlined modification, you don’t have to complete the Borrower Response Package. The lender can modify your loan immediately to avoid the risk of foreclosure.

What Does the Flex Modification Program Offer?

Eligible borrowers may get a more affordable mortgage payment so they aren’t at risk of losing their home.

Lenders have a few options when modifying your mortgage, including:

- Adjusting your interest rate

- Extending your loan term

- Adding the past due amount to the back of the loan and re-amortizing your loan over the new extended term

One final option is setting up a forbearance agreement for part of the loan (usually the amount past due). The lender would then amortize the loan using the current balance without the past due amounts, and the past due amount would become a balloon payment that’s due at the end of the loan. So if you keep the loan for the entire term, your final payment would be the full amount of what is due.

What are the Benefits?

Eligible borrowers experience many benefits with a Flex Modification including:

- Your home loan will be current once you pass the trial period.

- You won’t have to worry about losing your home if you remain current on your new payments.

- Your payments may be as much as 20 percent lower depending on how the lender adjusted your loan.

Do you Need to Apply?

If you are 60 – 90 days behind on your mortgage, you can apply for a Flex Modification if Fannie Mae or Freddie Mac owns your loan.

But, lenders are required to offer the program to any borrower who is 90 days to 105 days past due. So if you are late on your mortgage, you may see this offer from your lender. It won’t tell you the details of the arrangement or what you qualify for, but they will offer you the chance to check your loan and the possibilities to modify it.

By law, if you apply for a modification more than 37 days before your home goes into foreclosure, the foreclosure proceedings must stop. The lender may process your request for a modification, and they start foreclosure proceedings again unless you don’t meet the requirements for a modification.

Passing the Trial Period

All borrowers who get approved for the modification program must go through a trial period. It usually lasts 3 to 4 months. The lender uses this time to make sure you can afford the payments. You must make the payments on time to ‘pass the trial period.’ If you don’t pass, your loan reverts to its original state, and you risk losing your home.

If you make the payments on time, though, the modification replaces your original mortgage and you have a new payment.

Get Help if You’re Struggling

If you’re struggling to make your home loan payments, ask for help. Most lenders are offering the program that has helped millions of borrowers keep their homes while making their loans more affordable.

It’s essential to contact your lender as soon as you know you’re struggling.

Don’t wait and let the home go into foreclosure.

If you wait too long, it could leave you without any options. Discuss your options with your lender, ask as many questions as you need, and figure out the plan to help you keep your home during these trying times.

To get free help online, visit our online mortgage forum at this link.

For those out there who need some housing counseling, please visit the Consumer Financial Protection Bureau’s (CFPB) “Find a Counselor” tool to search for counseling agencies in your area.

Call the HOPE™ Hotline at (888) 995-HOPE (4673) or for other mortgage and financial resources, visit: https://www.consumerfinance.gov/coronavirus/

Or visit HOPE NOW and Neighborhood Assistance Corporation of America (NACA).

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Aug 5, 2021 | Mortgage Help |

To qualify for a loan workout such as a loan modification, short sale, or forbearance, you as the property owner must write a hardship letter to your lender to prove that you are facing financial difficulties. The purpose is to explain the details of your financial situation and the reasons why you can no longer afford your mortgage payments and detail the steps you are taking to correct your problem.

Having a well-written hardship letter is one of the most critical steps in getting your request approved. In this article, we will explain how to write one and give you a couple of examples that you can use as a template for your own letter.

When writing your letter, it’s essential to understand what your lender wants to hear. They want you to write out a solution that makes sense and will help you afford your payments and stay in your home.

You can let them know what you feel you can afford each monthly payment or even what modification programs you think you may qualify for. This will make your lender aware that you are ready to take on a new affordable loan and continue paying your monthly payments.

It would help if you remembered to be as honest as possible because your lender will also require all of your financial information and run a credit report. If your lender finds that you have lied about your financial situation, your request will automatically be denied.

Also, make sure that your letter is not too long and straight to the point. You do not want to write a 3-4 page letter because most reps will not take the time to read the entire letter. Remember that mortgage servicers and lenders are entirely overwhelmed with requests because of the current economic crisis.

EXAMPLE HARDSHIP LETTERS

Eligible hardships include job loss, income reduction, illness, relocation, divorce, medical bills, death of a spouse, etc. In your letter, you will also want to note when each event occurred and include any documentation that you can. For example, if you recently lost your job, you will want to show that you have a new job or are actively searching for employment.

Here are some examples that lenders will consider:

Divorce

Reduced Income

Loss of Job

Illness

Death in family

Military Duty

Incarceration

High Medical bills

Significant damage to property(such as vandalism or natural disaster)

Now that you know what hardships your lender is looking for, you are now ready to begin writing your own. But keep in mind that this is only one factor of the loan workout process. Your lender will not automatically assist you just by reading your letter, and there will be many other factors involved as well.

Here are two example letters were written by real homeowners and members of the LoanSafe forum who had received a loan modification from their efforts.

Name: (Your Name)

Address: (Your Address)

Lender Name: (Your Lender)

Loan #: (your Loan #)

To Whom It May Concern:

We are writing this letter to explain the extreme financial hardship it will be for our family when our loan adjusts from a 7.75% interest rate to a 10.75% interest rate in August 2020. This interest rate adjustment will cause our payment to dramatically increase in the amount of $1695 per month on top of our current payment of $4234.10, increasing the payment to $5929.10 per month. Our current income does not support an increase of this magnitude. As a matter of fact, a monthly increase of this amount will ruin us financially, and within a few short months of this adjustment, we will surely fall into foreclosure as we will not be able to afford the monthly payment.

We conducted a counseling session with a woman named Deborah Winston (888-669-2227 x742) from 995-HOPE and submitted a monthly budget where we only have a surplus of $158 per month after we pay all of our monthly obligations. According to the counselor, we are currently utilizing 54% of our monthly income for housing costs which is way above the national average.

My husband, Kevin, is the bread winner in the family and his income varies from paycheck to paycheck because of overtime, holiday pay (2 times per year), and uniform allowance. So, sometimes he makes his base pay of approximately $7839 per month and other times he makes more than that depending on the overtime he works each month. However, overtime is never guaranteed, so we cannot depend on the overtime in order to fulfill our monthly obligations.

I am currently receiving Social Security Disability in the amount of $1435 and am also the payee for our son, Christian, in the amount of $717 per month. Also, I receive a check from Calpers for my disability retirement in the amount of $829.74.

We would appreciate the opportunity to work out a loan modification where our interest rate will be frozen at the 7.75% interest rate for the DURATION of the loan, if the rate is just frozen for 2 to 5 years we will find ourselves in the same situation in a few short years from now.

Please take the time to review the information we submitted and consider our request. It is very important to us that we keep our account in good standing and preserve our credit rating as well as protect our main asset….our home.

Thank you in advance for your time and consideration in this matter. We are looking forward to working with Option One to resolve this situation. If you have any questions please contact us at xxx-xxx-xxxx.

Sincerely and Respectfully,

Borrower’s Signature

Date

Co-Borrower’s Signature

Date

————————————————————————————————————————————-

Sample Hardship Letter #2

Name: (Your Name)

Address: (Your Address)

Lender Name: (Your Lender)

Loan #: (your Loan #)

To Whom It May Concern:

I am writing this letter to explain my unfortunate set of circumstances that have caused us to become delinquent on our mortgage. We have done everything in our power to make ends meet, but unfortunately, we have fallen short and would like you to consider working with us to modify our loan. Our number one goal is to keep our home, and we would really appreciate the opportunity to do that.

There are several reasons that caused us to fall behind on our payments:

a) On July 6, 2019 my husband, was laid off from his job with IBM. He no longer receives Unemployment Compensation from the State of Florida as of January 2020.

b) Since July 2019, we went down to one income and were unable to keep up with the higher mortgage payments due to our escrow account from the beginning of 2019 being short on funds due to raised taxes and insurance coverage in Flagler County, FL.

c) In November 2020, we had to fly out of State for a family emergency which did not enable us to make that months payment.

d) Since we no longer have medical coverage, I had to pay for my visits to the doctor on several occasions due to prolonged and excessive menstruation. The Doctor Office would not see me unless I had full payment at each visit.

e) Since there is only one income in our household, but my husband helps me with my business while still looking for a comparable job, I must travel a lot. Gas prices have become extremely high, if I do not travel to do presentations and meet with clients, I cannot assure growth.

It feels like catch up for those two months we fell behind on is almost impossible, I assure you we have every desire of retaining our home and repaying what is owed to Bank of America. But at this time we have exhausted all of our income and resources, so we are turning to you for help.

Our situation is getting better because, like I stated above, my husband and I have combined forces, and we are working my business together in order to ensure stability and growth in our income, and we feel that a loan modification would benefit us both. We would appreciate if you can work with us to lower or delinquent amount owed and/or our mortgage payment so we can keep our home and also afford to make amends with Bank of America.

We truly are looking forward to you working with us, and we are anxious to get this settled so we all can move on.

Sincerely and Respectfully,

PLEASE JOIN THE LOANSAFE FORUM!

You can find more examples of various hardship letters right here written by different homeowners in the LoanSafe forum. =

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Aug 5, 2021 | Mortgage Help |

A loan modification changes your current mortgage contract, such as a reduced interest rate or extended loan terms agreed upon by the lender and the homeowner.

For homeowners struggling to manage or behind on their current mortgage payments, a loan modification will probably be the best option to help your current situation. The purpose is to help make your mortgage more affordable so you can avoid foreclosure.

For example, the lender modifies the existing loan(s) to work with the homeowner because of financial hardship by changing the mortgage terms from an adjustable-rate mortgage (ARM) to a fixed-rate loan. They may also extend the loan term from 30 to 40 years or decrease the current interest rate to make the monthly payment more affordable.

Every mortgage servicer in the U.S. has loss mitigation programs in place and offers loan modifications to borrowers who they deem are qualified. But please keep in mind that they are not required to modify your mortgage, and there are no laws that state they must fix your loan so you can save your home.

A key factor required in every loan modification submission is the existence of hardship. The hardship can be temporary in nature or permanent. Still, the borrower must prove the hardship such as financial hardships, job loss, loss of income, rate adjustments on adjustable-rate and subprime mortgage products, etc.

The earlier you address the issue, the better the chances of negotiating a fixed rate and a manageable payment.

What are the types of hardships?

The following list are a sample of hardships that are deemed acceptable by mortgage servicers

1. Adjustable Rate Mortgage – Reset-Payment Shock

2. Illness of the Borrower

3. Illness of a Borrower’s Family Member

4. Curtailment of Income

5. Loss of Job

6. Property Problems

7. Inability to Sell the Property

8. Mortgage Servicing Problems

9. Reduced Income

10. Failed Business

11. Job Relocation

12. Death of the Borrower

13. Death of Spouse or Co-Borrower

14. Death in the Family

15. Incarceration

16. Divorce

17. Marital Separation

18. Military Duty

19. Medical Bills

20. Damage to Property (natural disaster or unnatural)

How does the process work?

A loan modification is simply done by negotiating a lower payment with your current lender on your current mortgage contract.

The process works by modifying and improving the current terms and/or the interest rates on your existing mortgage. Do not confuse it with refinancing because you would not be making payments to satisfy an existing loan; this means that there are no loan closing costs.

It can easily take anywhere from three to twelve months or more to complete, and in some cases up to two years or more. Even if you feel like you’re a perfect candidate for a loan modification, you will most likely have to jump through several hoops before you reach success.

Just try to always be very polite – but firm – each and every time you communicate with your servicer. Keep track of dates/times and the name of any representative you speak with, this may come in handy later if you get conflicting information from a separate department.

The key when applying for a loan modification is to have patience and be persistent. This process may take a long time and be stressful. Try to control this stress and understand that what you cannot control is not good to stress over. This is just business to these big banks and mortgage servicers. If you remember this and do the same yourself, it will help you deal with the stress and sometimes the comedy of it all.

Do the best you can, stay as positive as possible, and hope for the best. By doing this you will take care of business, and also have a life with your loved ones.

What will I need to apply?

Here is a list of items you will need when you submit your loan modification. It is best to gather all these items before you even approach your mortgage servicer and keep this paperwork all organized in a single file for quick reference and or updating.

1. Financial statement

This worksheet can be defined as a document that contains a borrower’s monthly income and expenses that they wrote down. Accuracy of the information on this worksheet is a major factor in eligibility. The absence of debts may disqualify you, due to the fact that your servicer is going to uncover them eventually whether they are on the document or not.

2. Hardship letter

As mentioned above, hardship letters help to outline the events that have led to your mortgage becoming unaffordable. Although crucial information needs to be addressed in this letter, it also needs to be straight and to the point. Using over 2 pages to describe your situation is actually overdoing it.

3. Proof of income

Usually, income must be verified for each borrower who lives in the primary residence. Evidence of income classifies as:

– Monthly pay stubs for salaries of hourly wages.

– Most recent quarterly profit and loss statements of the self-employed.

– Copies of statements or letters from providers of the unemployed or disabled who need federal benefits to live. The statements or letters should include how long you will be receiving the benefits or the 2 most recent bank statements proving the income.

– The copies of the divorce decree, separation agreement, or other agreements in writing filed with the court explaining how much you will be paid and the amount of time in which it will be received for those who receive alimony or child support.

4. Tax Authorization (IRS 4506T-EZ Form)

Your lender needs this form for permission to request a copy of your most recent tax return from the IRS. Borrowers should make copies of this form for their own records.

5. Bank statements

At least two months of bank statements are required when applying for a loan modification. Bank statements enable a lender to see your total income and expenses and how they are being distributed each month. This transparency will help them make their decision. It is common to have to send in statements multiple times during the process, so trying not to get frustrated.

Here are some more tips to help you along in the process

1. Being punctual

Instead of waiting to default on your monthly payments, you could contact your servicer’s loss mitigation department to apply for assistance. Waiting to get into trouble never helps make a situation better. If you are suffering financially, take action. Patience is a virtue that must be practiced during the loan modification process, not before you even think about submitting the application.

2. Researching

As we promote nearly daily here on LoanSafe, the best way to get the best options is to do your research. While starting at resources like our own forum here on LoanSafe.org can be helpful, the best research always comes from the source. The Making Home Affordable Program, the Freddie Mac Streamlined Modification Initiative, the Fannie Mae streamline, and several other loan modification sources all have websites that anyone can go to for more information.

3. Writing

Hardship letters are always vital tools for borrowers who are facing the reality of foreclosure. While being comparable to hardship evidence, a hardship letter differs in that it sets the stage for a borrower to open up to their lender or servicer and allows them to be honest about their situation. Loan modification and short sale processes generally request it. Sample hardship letters and instructions can be found here on here on LoanSafe.

4. Staying organized

Because all loan modification programs request basic financial information such as paystubs, bank statements, 2 years’ worth of tax returns, recent mortgage statements, and a financial budget you have, the organization is more vital than ever when pursuing a loan modification in 2014.

5. Remaining assertive

When trying to get a loan modification in 2014, you’ll want to remain respectful while at the same time never taking no for an answer. Because the submitting of an application requires constant follow-ups on the phone, it takes the right type of assertiveness of the phone when going after a loan modification. Calling at least 2 times per week will help obtain a positive outcome.

6. Being realistic

Realism does not mean signing the first deal that is presented to you. Bargaining still exists in a world where regulations are ruling the industry. At the same time, remember that those with the power are the ones who make the final decisions; Especially if your loan is owned by Fannie Mae or Freddie Mac.

7. Document everything

This trait falls under the category of staying organized as well. Legal ramifications require borrowers to leave paper trails for themselves in order to get as much help as possible with the least amount of trouble possible. Keeping detailed logs, notes on conversations, and tabs on status updates are crucial tools when pursuing a loan modification this year.

8. Being patient

With some timelines adding up to 90 days to complete, the loan modification process is a process that requires the utmost patience.

IMPORTANT NOTE: It is essential during the loan modification process that you call your servicer regularly after you have sent them all your paperwork. Finding out which department is handling your file is crucial as well.

Where can I find more assistance?

What if I need help negotiating with my lender or do not have enough time to call in weekly for updates?

For those out there who need some housing counseling, I suggest you visit the Consumer Financial Protection Bureau’s (CFPB) “Find a Counselor” tool to search for counseling agencies in your area.

You can also call the HOPE™ Hotline at (888) 995-HOPE (4673) or for other mortgage and financial resources, visit: https://www.consumerfinance.gov/coronavirus/

There are some excellent non-profit organizations out there that can assist you through this difficult process. Two non-profits I have found to be very reputable over the years are HOPE NOW and Neighborhood Assistance Corporation of America (NACA).

Now that you have some information about modifications, it is now time for you to begin the process yourself.

You can also join our free forum with any questions they may have, where you will find many homeowners just like yourself in need of assistance.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Aug 1, 2021 | Mortgage News from LoanSafe.org |

A San Francisco couple received a record court settlement of nearly half a million dollars for agreeing to leave their luxury apartment of thirty years.

The $475,000 voluntary buyout was paid to a couple in their 60s with teenage children who were paying $12,500 a month for two apartments consisting of seven bedrooms and eight baths with expansive views of the bay, Golden Gate Bridge, and nearby Presidio park.

The settlement is considered the largest in the city’s history, showing what some landlords must go through to evict long-term tenants in a city with some of the strictest rent controls in the nation coupled with soaring market rents.

San Francisco’s tenant laws and rent control ordinances go back to 1979 to alleviate the city’s housing crisis. Landlords can only raise the rent by 1% a year on some properties, and they cannot evict tenants without just cause, such as nonpayment of rent, and they must also pay tenants to vacate

The couple was represented by lawyer, Steven Adair MacDonald.

The San Francisco Gate reported:

“More than 300 tenant buyouts were filed with the San Francisco Rent Board in 2020. MacDonald said average buyouts are $50,000, and they are growing given the difference between market rent and length of tenant residency.”

“Landlord attorneys think it’s an outrage, and on the tenant side, everybody’s excited, they think it’s great,” he said. But MacDonald thinks the landlord is the winner, as he will be able to rent the apartment for $25,000 a month and recoup the buyout amount in just over three years.

“After that, it will be gravy, so it’s a great investment,” said MacDonald.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.