by Moe Bedard | Apr 12, 2022 | Mortgage Rate News |

Mortgage interest rates go up and down daily, sometimes hourly. A rate lock means that the interest rate won’t fluctuate from what you were offered and closing.

As mortgage rates rise, borrowers are opting to lock their rates during the underwriting process rather than gamble with uncertainty.

The number of people locking their rates went up 19.1% month over month for March, according to the latest report from Black Knight.

Black Knight said the increase was driven by a 31% increase in purchase volume, which is now up nearly 70% over the past three months.

The cash-out refinance share of the market remained flat in March, which was 1.6%. The rate/term refinance drops continued, and the market share is now down to 28%.

That’s the lowest since November 2018. Non-conforming loan products are gaining ground, too, as their pace of growth for home prices has reached record highs.

According to Scott Happ. president of Optimal Blue, a division of Black Knight;

“Mortgage interest rates spiked in March, with 30-year offerings climbing 70 basis points over the course of the month.

In fact, our OBMMI (Optimal Blue Mortgage Market Indices) daily interest rate tracker showed the average 30-year conforming rate reach as high as 4.93% late in the month before pulling back slightly to close out March at 4.79%,” he said.

“As home prices continue to climb — even in the face of sharply rising interest rates — we’ve seen the average loan amount rise as well.

The average loan rose by $8,000 to just under $362,000 in March, representing a more than 23% increase over February’s rise,” Happ said.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Apr 12, 2022 | Mortgage News from LoanSafe.org |

A new report from Redfin shows that demand for second homes and vacation homes is falling, and they call it an early sign of the housing market slowing down.

The company says that increases in mortgage rates and fees for second home loans are making it more difficult for buyers.

“The pandemic-driven surge in sales of vacation homes is coming to an end as mortgage rates rise at their fastest pace in history, causing some second-home buyers to back off,” Redfin Deputy Chief Economist Taylor Marr said.

“When rates and prices shoot up so much that a vacation home starts to look more like a burden than a good investment and a fun place to bring your family on the weekends, a lot of prospective buyers have second thoughts.”

The slowdown comes after a two year boom in U.S. vacation home purchases that saw an 87 percent increase above pre-pandemic levels in January 2022, according to Redfin.

The Federal Housing Finance Agency also recently announced that it would raise fees charged by Fannie Mae and Freddie Mac on second-home loans.

The fee increase could be an additional will increase between 1.125 percent and 3.875 percent, tiered by loan-to-value ratio. It could add up to $12,000 to a $300,000 mortgage, which is payable upfront or rolled into the loan.

The new pricing takes effect for loans that Fannie or Freddie purchased on or after April 1.

While demand for secondary homes decreased, Redfin said “demand for primary residences outpaced that of second homes for the second month in a row.”

However, they say it’s partly due to the decrease in those buying second homes, since “demand for primary residences” has been about the same since June 2020.

Additionally, the higher mortgage rates are making monthly costs for homebuyers go up sometimes as high as an extra $500 per month, according to Redfin. They say the increasing rates are “driving a sense of urgency to buy before” they go up again, causing potential buyers to back off as their budgets are “exceeded.”

As the housing market remains strained, Daryl Fairweather, Redfin’s Chief Economist, says it may not be all bad.

“Homebuyers may not feel like the market has gotten any easier. That’s because they’re often competing against investors, all-cash buyers and migrants from expensive cities who aren’t as sensitive to mortgage rates,” Fairweather said.

“But there are early indicators that the market is turning, and we expect the softening to become more apparent in the coming weeks, eventually causing home-price growth to slow.”

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Apr 12, 2022 | Mortgage Help |

Homeowners with mortgages backed by Fannie Mae or Freddie Mac are eligible for a two-month extension to avoid foreclosure if they apply to the Homeowner Assistance Fund, according to an announcement on April 6, 2022, by the Federal Housing Finance Agency.

Mortgage servicers will have to suspend foreclosure activities for up to 60 days for eligible homeowners. Assistance can also come in the form of lower mortgage payments and paying utility bills.

“FHFA is committed to sustainable homeownership. Today’s action will provide borrowers who need temporary mortgage assistance with additional time to be evaluated for relief through their state’s approved Homeownership Assistance Fund,” said FHFA Acting Director Sandra L. Thompson.

As of December 31st, there were 178,019 mortgages in forbearance, down from 320,009 in the third quarter, according to an FHFA spokesman, Adam Russel.

Out of the leading states with these mortgages in forbearance, California and Texas ranked number one and three with more than 20,000 and nearly 17,000 mortgages, respectively.

The Homeowner Assistance Fund was created by the CARES Act and is administered by the Treasury Department, provides up to $10 billion to help struggling American homeowners.

Who qualifies for the Homeowner Assistance Fund extension?

To qualify for this two-month extension, homeowners must apply for assistance from the Homeowner Assistance Fund (HAF). The fund covers homeowners who are behind on their mortgage payments due to COVID-19 and don’t have an alternative source of assistance.

Eligible applicants must meet these criteria:

* The homeowner either had a financial hardship caused directly by COVID-19, or they have experienced financial difficulty due to COVID-19 that makes it hard to pay their mortgage.

* They must have a mortgage backed by Fannie Mae or Freddie Mac. To find out if that’s you, go to Fannie Mae’s Lookup Tool or Freddie Mac’s Loan Lookup Tool. Or contact your mortgage servicer directly.

* The original loan must have been sold to Fannie Mae or Freddie Mac before June 1, 2021. Although the loans can be delinquent, they cannot be in foreclosure at least 90 days before applying for HAFA.

* Not already be behind on payments at the time of application.

* Be part of a household with income 80% below the area median income in the location of their property, but only if that amount is no more than $100,000 annually.

* Not have an interest in another residential property at the time they apply for assistance.

The foreclosure moratorium expired on July 31, 2021. However, some states and local governments have temporarily stopped foreclosures.

Homeowners who need mortgage help can visit consumerfinance.gov/housing for up-to-date information on their relief options, protections, and key deadlines.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Apr 11, 2022 | Mortgage News from LoanSafe.org |

Mortgage delinquencies are on the rise, and our national delinquency rate has just risen for the first time in 9 months, according to the latest report from Black Knight.

The number of properties that are 60 or more days past due or in foreclosure reached over 1 million nationwide, and foreclosure starts have increased 541% from the same time last year.

Nationwide, there are 1.95 million properties with more than 30 days of delinquency.

A contributing factor to this was a 97,000 increase in early-stage delinquencies. This is when a property is either 30-60 days past due or in foreclosure.

The number of homes in serious delinquency — 90 days or more past due — dipped slightly by about 2,000 loans, but remained at the highest level since 2013.

The largest increases in delinquencies were seen in the Northeast U.S., where rates climbed by 5%, and in the Midwest, where rates increased by 4%. In contrast, mortgage delinquencies fell by approximately 14% in the West and by 1% in the South.

The largest month-over-month increase in two years occurred in the Northeast, and it’s largely driven by the hardest-hit states, including New York, New Jersey and Connecticut.

For example, in New Jersey, early stage delinquencies rose by 56%, and in New York, the rate was up 42%, compared to last year. Connecticut had a 36% increase in early-stage delinquencies.

Black Knight explained that the increase in early-stage delinquencies was driven primarily by “a sharp uptick” among loans that were current just three months ago — particularly those with an initial six-month payment deferral.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Apr 10, 2022 | Mortgage News from LoanSafe.org |

Elon Musk is a well-known entrepreneur and billionaire who is best known for his roles in Tesla and SpaceX.

He has plenty of money, but recently he took out several very large mortgages on five properties in California.

When he borrowed this money, Musk faced some big decisions about which type of loans to go with. There are two options: fixed-rate mortgages or adjustable mortgages.

Fixed-rate mortgages provide the borrower with a guarantee of stable monthly payments.

Adjustable mortgages don’t offer that same benefit, but they do come with substantially lower rates.

Musk chose to take a big risk with his mortgage loans.

Instead of choosing a 30-year fixed-rate mortgage – which would have given him stable monthly payments – Musk chose a hybrid-adjustable loan (ARM).

The Tesla CEO, 49, took out several mortgages worth more than $61 million to buy five adjacent homes in the posh Bel-Air neighborhood of Los Angeles where celebrities like Jennifer Aniston and Kim Kardashian live, according to property records reviewed by Business Insider.

He bought two of the houses – which are located near one another in Bel Air – in 2012 and 2013 for $17 million and $6.75 million, respectively.

Musk bought one of the houses from actor Gene Wilder for $6.75 million, and another from actress Talia Shire for $6.4 million. The other three are located in the Hidden Hills neighborhood of Los Angeles and cost him $24 million combined.

For his new mortgages, Musk secured a floating rate loan with a 3% interest rate for the first six months, which will then increase to 4.5%, according to property records filed with the county recorder’s offices for Los Angeles County, San Mateo County and Alameda County in California.

The loans total $24.6 million from Citibank and $36.3 million from Morgan Stanley.

Musk was able to borrow a high-risk mortgage because he’s a billionaire.

With his wealth, he could afford to take a chance with an ARM mortgage and see his rates go up and payments rise if and when that would happen.

Musk was unlikely to find himself in a position where he couldn’t refinance his loan if needed, especially given his personal wealth and long-established borrowing relationships with major banks.

The typical borrower, however, might not be so equipped to bear the risk of an adjustable-rate mortgage.

The average person would likely find themselves in serious financial hardship if their rates rose — and there’s a good chance they will continue to do so in the forseable future.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Apr 9, 2022 | Mortgage Help |

If you want to buy a home, but don’t have enough money for the down payment or if you are having credit problems, then there is another option.

It’s called the lease option or lease-purchase plan to buy a home.

It’s also a way for those homeowners who want to sell their house, but can’t get their price and those who can’t qualify for a mortgage to come together and agree on a mutually beneficial arrangement.

In most cases, the owner agrees to sell his property for a specific price within a certain time frame and the tenant agrees to rent with an option to buy.

These agreements often require the tenant to pay an agreed upon amount each month toward his future down payment or closing costs, or both.

Not all lease options are created equal.

Some are more similar to rental agreements and offer very little opportunity for the renter to build any equity in the home.

The best lease options give the renter/buyer an opportunity to treat the home as if it was their own, build some equity, and still have time to shop around for financing before taking on the contractual obligations of a mortgage.

This will alllow for a portion of the rent that would be applied toward the purchase if the option is exercised. This is referred to as rent credit.

How it works

You enter into a contract with the seller for a specified time (usually about one to three years), during which you pay rent, and a portion of your monthly payment goes towards the purchase price of the home at an agreed-upon price.

This option means that you can decide whether or not to buy the home at the end, but if you do want to buy it, you’ll have first rights, as long as your contract isn’t up.

The seller keeps all of your monthly payments, minus any rent credits, until you decide to exercise your option. If you don’t buy, he gets to keep all of those payments. You don’t get any money back or credit toward rent.

The option fee is usually nonrefundable and acts as the buyer’s deposit. It may be credited toward closing costs if and when the tenant exercises his or her option to buy.

For example, if you paid $2,000 for an option fee and $5,000 toward closing costs when you bought the house, you’d have $7,000 in equity right off the bat.

In addition to paying rent each month, the tenant pays an extra amount to go toward a down payment on the home.

The more of these “option payments” that get applied to the down payment, the less money will be required from the tenant at closing.

If you exercise your option and purchase your home, your landlord/seller credits your monthly option payments against your down payment.

The lease portion of the agreement outlines the rights and responsibilities of both parties during the lease term, including how repairs will be handled, who pays for maintenance, whether pets are allowed and whether the property can be subleased.

The primary benefit of a lease purchase agreement is that it can allow people with bad credit or no cash to live in a property they might otherwise be unable to buy.

In addition, many sellers of properties under lease purchase agreements are willing to make improvements or repairs to the home before selling it to the tenant.

This gives both parties an incentive to close on the sale: The owners get their money, and the tenants get their repairs.

This type of agreement can be ideal for people who might not otherwise qualify for a mortgage, or who want more time to prepare for homeownership.

Because your monthly payments will generally be higher with a lease-option than with a straight rental, you should carefully consider whether you can realistically afford this type of agreement before signing on the dotted line.

The time frame for when your option expires; if you are not able to exercise your option during this time, you may lose any money that you have paid toward the purchase price.

If you’re thinking about entering into a lease option, make sure you understand what your rights and obligations will be during that agreement period.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Apr 7, 2022 | Mortgage News from LoanSafe.org |

Rising mortgage rates on FHA loans are driving up monthly payments, making it harder for many to afford.

FHA loans have long been touted as one of the most effective ways for first-time homebuyers to get a mortgage. But with rising interest rates — and a lingering threat of more — FHA borrowers are about to face more pain.

For home buyers, the difference between qualifying for a 3.5% down FHA loan and a 5% conventional loan is significant: about $150 per month on a median-priced home in the U.S., according to one analysis from mortgage data provider CoreLogic.

For people who already have a FHA loan, borrowers will likely see their monthly payments increase due to higher interest rates, which could hurt their financial situation if they don’t have other income streams coming in or an emergency fund set aside in case they lose their job.

If you purchased your home a few years ago, or even just last year when rates were at historic lows, you might be surprised to learn how much higher the rate is today.

The average 30-year rate on FHA-backed loans has risen from 3.97 percent in January to 4.68 percent as of this writing, according to data provided by Ellie Mae, an industry software provider.

That’s a rise of 0.71 percentage points in just six months, and it translates into higher payments for all new FHA borrowers:

$1,429 monthly on a $200,000 loan — an increase of $160 monthly or $1,920 annually

$2,073 monthly on a $300,000 loan — an increase of $239 monthly or $2,868 annually

$2,888 monthly on a $400,000 loan — an increase of $328 monthly or $3,936 annually

Each 1-percentage-point increase in mortgage rates is equivalent to a 10 percent drop in home affordability, according to Trulia.

“FHA buyers are going to get squeezed,” said Jed Kolko, chief economist at Trulia. “They’re going to have higher house payments.”

The rate spike isn’t the only problem facing borrowers with FHA loans right now. Insurance premiums are also expected to rise in coming years — and those increases will hit people who took out their mortgages before the hikes were announced.

The average interest rate on 30-year fixed-rate mortgages increased from 4.20% in March to 4.37% in April, according to mortgage finance agency Freddie Mac (FMCC).

Meanwhile, the average rate on 15-year fixed-rate mortgages rose from 3.43% in March to 3.57% in April.

Just a few months earlier, rates were hovering around 3.5 percent. Homeowners with ARMs are also feeling the pain of higher rates, though the impact will be somewhat less immediate.

The reason for the increase is simple: The Federal Reserve has been raising short-term interest rates as the economy improves and unemployment levels drop.

It’s also winding down its monthly bond purchases that have kept mortgage rates at historic lows.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Apr 5, 2022 | Mortgage Help |

The Department of Housing and Urban Development (HUD) and the Federal Housing Administration (FHA) are seeking to initiate a new 40-year loan modification program to help mortgage borrowers and lenders streamline the loss mitigation process.

The proposed rule, published by HUD late last week, would change repayment provisions for FHA borrowers, allowing lenders to modify a borrower’s total unpaid loan for an additional 120 months.

HUD said that this option could prevent “several thousand borrowers a year from foreclosure.”

According to HUD, the proposed change would allow FHA lenders to modify mortgages where borrowers experience long-term COVID-19 forbearance due to job or income loss, or where the borrower is subject to an extension of forbearance or additional payment period.

“This will give these borrowers longer periods of time to recover financially before their mortgage payments go back up to their original amount,” said HUD Secretary Marcia L. Fudge.

As part of the plan, if a lender chooses to offer a 40-year modified mortgage to an eligible FHA borrower, the agency will reimburse 100% of the unpaid principal balance owed on the loan at the time of modification. The reimbursement will be made in one lump sum payment upon completion of all terms and conditions in the modification agreement.

HUD also specifies that the monthly payment on a 40-year loan must be no less than the payment on a 30-year loan because it would not want to encourage borrowers to take out loans they can’t afford.

To qualify for the option, FHA borrowers will need to provide documentation demonstrating functionality in their repayment plans and show that they can afford monthly payments based on their current income levels.

Borrowers must also be current on their mortgage payments for at least 12 consecutive months following the modification under this proposal. The proposal is not available for borrowers who are currently in bankruptcy proceedings or who have already had one or more delinquencies within 24 months of their modification request.

In addition, the proposed rule would allow lenders to process loan modifications for delinquent borrowers in cases where they would otherwise be ineligible due to delinquency. Additionally, HUD said that it is considering additional special application and income verification procedures.

“Since March, HUD has been focused on protecting our nation’s homeowners from the financial impacts of COVID-19 through our innovative loss mitigation strategies and programs,” said HUD Secretary Ben Carson. “We believe that this proposed expansion will allow thousands more struggling families to keep their homes and provide them with time to get back on their feet after this challenging time.”

In June, the FHA introduced a new long-term loss mitigation program for borrowers impacted by the COVID-19 pandemic. The new “waterfall” included a six-month forbearance option, the extension of temporary COVID-19 loss mitigation options, and a new permanent FHA COVID-19 loss mitigation option.

HUD said it believes that this proposed change will help streamline loss mitigation efforts for FHA-insured single family mortgages and will ease the operational burden on its lenders. This new option would allow eligible mortgages currently in forbearance or in default due to COVID-19 related hardships to access longer-term modifications.

The FHA is looking to the mortgage industry to help the agency determine if the 40-year loan modification program is a good idea. The agency is currently taking comments from lenders and other interested parties about the current loss mitigation options, including whether or not a 40-year loan mod should be made available.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Apr 4, 2022 | Mortgage News from LoanSafe.org |

A new Redfin report says the rush to purchase second homes dropped in February to its lowest level since May 2020. Though demand is still up 35% above pre-pandemic levels, the vacation housing market will cool as rates rise.

The Redfin report shows that vacation home purchases dropped 38% year-over-year in February after falling 34% in January and 27% in December. The drop comes as the cost of borrowing rose at an accelerated pace following an increase in Treasury yields due to rising inflation expectations, soaring government debt issuance, and ongoing fears related to the COVID-19 pandemic.

Over the last couple of years, affluent homebuyers have been snapping up vacation properties at an unprecedented rate amid the pandemic and remote work flexibility. Many are moving out of cities and into suburbs and smaller cities or greener pastures in states with lower taxes and a more reasonable cost of living.

Before the pandemic, demand for second and primary homes grew at similar rates. But pandemic lockdowns and the Federal Reserve’s easiest monetary policies on record, coupled with FOMO and low inventory, unleashed a surge in buying panic in beach towns and mountain areas.

Upscale housing markets in Phoenix and Las Vegas saw double-digit increases in demand for luxury vacation homes this past winter compared with a year earlier as snowbirds flocked to warmer climates for COVID-19 respite and remote work escape options during the pandemic lockdowns.

But as rates rise, the market is more unaffordable to potential second home buyers.

Redfin found that demand for vacation homes declined 7% in February compared to January. The percentage of vacation home searches fell from 7% of all searches in mid-January to 5% at the end of February, “a bigger drop than we saw after last year’s election,” said Daryl Fairweather, Redfin’s chief economist.

“With mortgage rates now over 3%, they are starting to affect buyers’ decisions,” Fairweather added. “The slowdown in vacation home searches is a sign that it may be getting harder for many Americans to afford a second home.”

Mortgage rates on vacation homes have risen to 3.37% from 2.88% in January. A 30-year fixed-rate mortgage for a home purchase is now at 3.12%, the highest rate since July 2020.

The report says: “As interest rates climb toward 3%, that market is going to cool off. Affordability has been bolstered by historically low mortgage rates for much of the past year and a half. As those low rates start to disappear, we could see buying power dip and affordability decline once again. But there will be more sellers on the market this spring and summer than last year, which will help offset some of those effects on affordability.”

“With mortgage rates on an upward trajectory again, it’s likely we’ll see a drop in demand as people reassess what they can afford,” said Taylor Marr, senior economist at Redfin. “The future of the vacation home market will depend on how long mortgage rates stay elevated and if there is another round of stimulus that boosts buyers’ confidence.”

“Vacation home buyers have the most urgency about locking in low rates,” Redfin agent Kathleen Plinske said in a statement. “They’re generally wealthier, more stable and more risk averse than people looking for primary homes.”

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Apr 3, 2022 | Mortgage Assistance Programs |

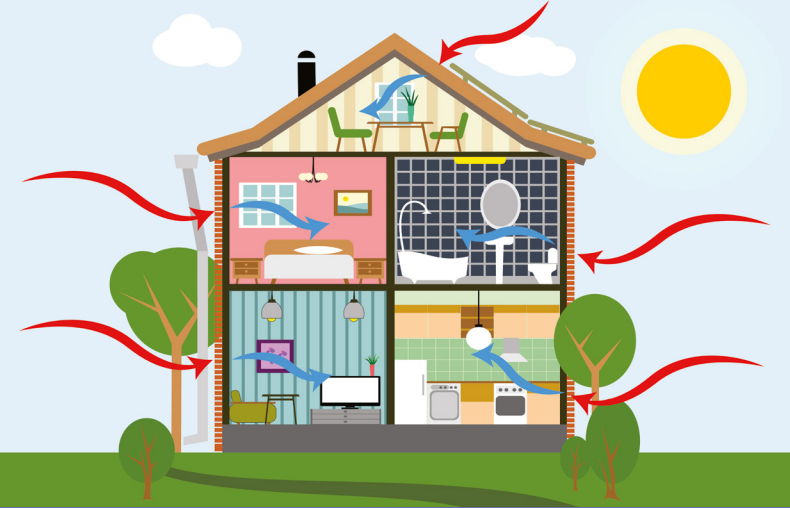

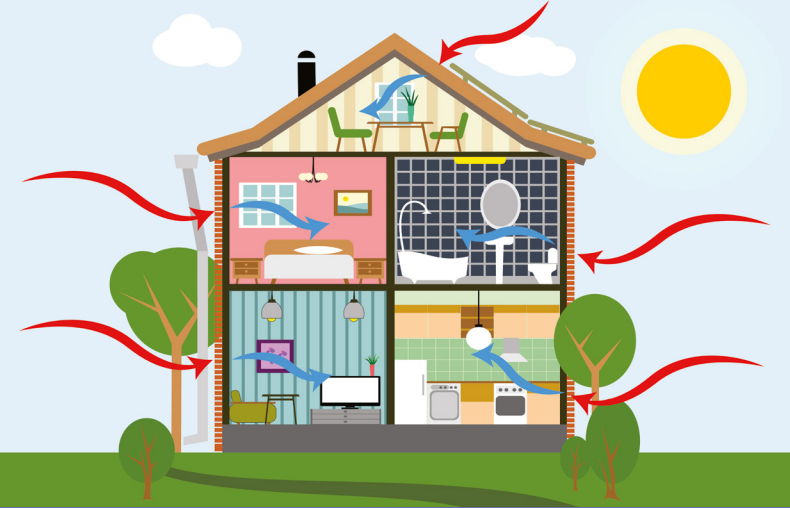

The Energy-Efficient Mortgage (EEM) program is designed to offer a financial incentive to homeowners who make energy-saving improvements to their homes.

The goal of the Energy-Efficient Mortgage program is to encourage homeownership while also promoting energy efficiency. Not only does this help the environment, but it also helps homeowners save on their utility bills each month.

The EEM is a special type of FHA loan that allows you to include the cost of energy-efficient upgrades into your mortgage. The cost of your energy improvements is added to your total mortgage amount, and you can still take advantage of the low down payments and credit score requirements offered by most FHA loans.

The EEM program allows homeowners to borrow money with no additional monthly costs, and the loan can be repaid when the house is sold.

The FHA EEM program is not a separate loan product — it’s an add-on to an existing FHA loan product. The EEM must be attached to a first lien 30-year fixe rate mortgage. The total cannot exceed 100 percent of the value of the property after improvements are made.

The borrower can receive up to $8,000 in down payment assistance (DPA) through an EEM.For example, if a borrower qualifies for an FHA loan with a 5% down payment, the maximum DPA they can receive is $4,000 ($8,000 x 5%).

The loan amount can be increased up to $3,500 for single family homes and $9,000 for multifamily homes (four units or less). This amount is determined by the lender and is based on the amount of the down payment required for the loan program and the household’s income.

You can also use an Energy-Efficient Mortgage if you’re refinancing an existing home, as long as the repairs are necessary to improve the health and safety of the property. You can also use an EEM if you are buying a new construction home and want to add energy-efficient features before moving in.

Energy efficiency improvements can include items such as solar panels, new windows and doors, insulation, and more. Disaster mitigation improvements include items such as flood-proofing and hurricane straps to reduce damage from floods or hurricanes.

To qualify for an EEM, you need to meet the following criteria:

Energy Audit – To qualify, homes must undergo an energy audit by a home inspector or contractor approved by the Department of Housing and Urban Development (HUD). The auditor checks the home’s insulation, appliances, lighting, and ventilation systems to see how efficient they are and determines whether they would benefit from upgrades.

The energy audit and report completed by a Home Energy Rating System (HERS) rater, who will determine the most cost-effective improvements to make and their estimated annual savings in utility costs.

The HERS rater provides this information on a label called a “home energy rating” that is used to estimate the property’s relative energy efficiency. After the audit, you get a list of suggested improvements and their costs.

FHA Loan

Your mortgage must be insured by FHA

Home Equity

You must have sufficient equity in your home to cover the cost of any work that is being done to make it more energy-efficient.

Valid Reason

You must have a valid reason for wanting to make these improvements, such as reducing your monthly utility bills or making it easier for someone with disabilities to live in your home.

The most common upgrades that qualify for an EEM include:

Solar panels

Insulation

Window replacements

Furnace replacements/upgrades

Water heater replacements

FHA’s maximum allowable insurable mortgage amount is 96.5% of the lower of the purchase price or appraised value plus the cost of any required repairs. If the borrower chooses to use an FHA EEM, it does not count against this limit.

All FHA programs with a down payment less than 20% or loan amounts above 80% loan to value require borrowers to pay mortgage insurance premiums (MIP).

This is an extra mortgage cost that is used to cover the risk to a lender, and that is paid by a borrower in monthly premiums tied into their mortgage payments. It is not for the benefit of the borrower.

This type of insurance is usually required by lenders when a mortgage loan amount is above 80% loan to value (LTV) and the borrower has less than a 20% cash stake in the property.

PMI payments range anywhere from 1% to as high as 1.5% of the loan amount that is amortized yearly and paid monthly throughout the life of their loan as long as the loan amount is above 80%, so you should factor this into your budget when deciding whether an Energy-Efficient Mortgage is right for you.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Apr 3, 2022 | Mortgage Rate News |

U.S. mortgage rates jumped again this week, according to Freddie Mac’s Primary Mortgage Market Survey of April 1st. The 30-year fixed-rate mortgage rose to 3.29% from 3.21% last week and 4.07% a year ago; the 15-year fixed rate moved up to 2.61% from 2.57% and 3.26%, respectively; and the 5-year ARM rate averaged 2.77%.

The U.S. economic recovery has been fueled by record-low mortgage rates and stimulus checks from the government to help support households during the pandemic. This led to a strong housing market with a balance of supply and demand, said Sam Khater, Chief Economist at Freddie Mac, in a statement accompanying this week’s survey results.

“Mortgage rates are now at the highest level since June 2020,” he added. “While the rise in rates will likely put some pressure on home sales going forward, we expect existing sales to remain close to 20-year highs.”

However, as rates continue to rise and new stimulus checks remain uncertain, economists expect the pace of home sales to slow down in 2021, as buyers are no longer able to afford as much house as they could before.

“The current Fed and Treasury policies have been effective (up until now) in driving down mortgage interest rates and stimulating credit demand by both consumers and businesses alike,” said Jim Baird, chief investment officer at Plante Moran Financial Advisors.

“That said, policy makers are clearly concerned about rising inflationary pressures which could potentially derail an already fragile recovery given the enormous amount of federal support currently in place.”

According to Freddie Mac’s report, “With vaccinations ramping up and fears of COVID-19 receding, more consumers are out shopping for homes, which is pushing prices higher while putting pressure on affordability.

In addition, the supply of homes remains tight as many homeowners who would be selling their homes are opting to stay put due to low inventory.”

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Apr 1, 2022 | Mortgage Help |

Figuring out how much mortgage you can afford is a process that involves several steps. Once you have gone through all of them and have thoroughly examined your financial situation, you can have a much better idea as to how big of a loan you can afford, and in turn, how big of a house to look for.

The general rule of thumb is that about a third of a borrower’s income should be dedicated to financing a home. For example, if someone makes an annual salary of $50,000 a year, they should be able to manage a mortgage of $150,000 if their current debt is moderate.

While this tends to be a common rule for some, it will not be the case for every new home buyer.

A good rule of thumb is to examine your current debt, living expenses, and then adjust for future financial obligations, like children, education, and possible retirement.

Instead of trying to spend all your earnings on buying a home, a more modest approach is sometimes necessary. There’s no better way to be well-prepared for homeownership than making a budget and sticking to it!

Aside from considering your regular monthly costs such as utility bills, car insurance, health insurance, etc. – finding out the exact mortgage costs you will be facing will help you determine whether or not the purchase is a sound financial investment.

You also need to keep in mind that a mortgage loan pays not just for your house, but also for the costs of owning a home, such as insurance, property taxes, and home maintenance. All of these things should be factored into your calculations when you are calculating your mortgage.

There are also many more factors such as your interest rate, credit score, debt-to-income ratios and down payment that affect the amount you can afford to borrow.

The best way to determine exactly what fees you’ll pay is to find a lender and pre-qualify for a mortgage. This process will allow a borrower to receive a loan estimate from the lender, which will have all of the exact costs associated with the mortgage.

Below I will discuss the steps and most effective ways for an individual to calculate how much they can realistically afford.

* If you need to quickly see how much mortgage you can afford and you do not want to read this entire article, please call me at 619-379-8999 or email me at [email protected].

STEP 1: Calculate Your Monthly Income

To qualify for a mortgage, you and your spouse must prove that you have enough income to cover all of your housing costs, including homeowner association dues and property taxes.

You should also add up all sources of your monthly income, including your spouse’s if you are married, alimony if you are getting some and any other income that you receive.

If you have a fixed-term employment contract or receive a salary from your job, then the calculation is easy. Just add up all of your monthly income and divide it by 12 to get the average amount of money you make each month.

Gross monthly income is the total amount of money earned before any deductions have been made. For example, if you make $45,000 per year and work 40 hours per week, then your gross monthly income is $3,750 ($45,000 divided by 12 months).

If your spouse earns $50,000 per year and works full-time. Her gross monthly income is $4,167 ($50,000 divided by 12 months). Adding these two together gives you a gross monthly income of $7,917 ($3,750 + $4,167).

If you receive variable or irregular income from self-employment, there are several things that you can do. For example, let’s say that you are self-employed and your income varies from month to month or year to year due to market conditions or seasonal factors.

To account for this in the calculation of your monthly income for mortgage purposes, simply average out the last 2 years of your income tax returns and use this figure as your monthly income when applying for a mortgage. These calculations can, however, be slightly tricky because some of the deductions on your tax return are added back into your net income like depreciation, depletion and one-time expenses/repairs.

If you were getting alimony every month or had another source of income such as an investment property, then include that as well. Also include any investments in stocks and bonds or annuities (regular payments) as well as any government benefits.

If you receive Social Security, Alimony, Child Support or any other income source that is Non-Taxable a lender may be able to qualify 25% above what you receive which will allow you to qualify for a slightly higher purchase price/loan if needed.

STEP 2: Calculate Your Monthly Expenses

In addition to this information about your monthly income, lenders will also want to know about your existing debts. This includes credit card debt and any other type of installment loans that you carry each month.

Lenders will take the sum of these debts and add it to your estimated mortgage payment to see if you have enough room in your budget before approving your loan application.

This will include any rent or mortgage, food, transportation, taxes, insurance, and other regular costs of living such as your car payment, credit card payments, utility bills, and other recurring costs.

STEP 3: Debt-to-Income Ratios

Mortgage lenders look at your gross monthly income and your monthly debts to determine how much of a mortgage loan you can afford. This is called the debt-to-income ratio.

Debt to income ratio applies to the comparison of an individuals monthly expenses to their monthly income. Lenders use strict debt-to income ratios when qualifying a borrower for a mortgage, so it is imperative that you get a basic understanding of how this is done.

The housing to payment ratio is referred to as your front-end debt-to-income (DTI) ratio and includes all expenses associated with the mortgage – including principal, interest, property taxes and homeowners insurance. To calculate an affordable front-end DTI, multiply 0.3 by your gross (pretax) annual income, then divide by 12.

In contrast, your back-end DTI is the percentage of your gross monthly income that is applied to all other installment debts (i.e., mortgages, student loans, car payments, credit cards, child support etc). One of the first things to do is itemize all of your debts, including credit card bills, personal loans, and car payments.

The back-end DTI shows the lender exactly how much of your earnings go towards your total debt obligations. Generally, they will look for a borrower with a DTI of around 43-55%. If your DTI is below 43% then you have a better chance of qualifying for a loan.

If your DTI is above 43% then you may have a more difficult time meeting the requirements. FHA mortgages allow a higher number with a front-end DTI of 47% of your gross monthly earnings, and a back-end DTI of 57-59%.

How to calculate your debt to income ratio (DTI)

To determine the size of a mortgage you can afford, your total monthly payment, taxes and insurance (PITI) should not exceed 2x to 2.5x your take-home pay or salary after taxes and other withholding are taken into consideration.

The first step is to calculate your gross monthly income.

To do this, simply figure out how much money you are making each month from all of your documentable sources throughout the year and now divide that by 12. If you are married, figure both incomes into the equation.

Remember I said “documentable”.

If you can’t prove it, it didn’t go into your bank account and or you do not claim it on your taxes, then it is not provable income.

Add up all your monthly debts

Things like a car, credit cards, and stuff that will show up on your credit report are what we are looking for. Figure out what percentage of your income is going towards paying off debts. Generally, figures like 5%, 10%, or 20% are used.

Of course, the lower the better, as you will be more likely to be able to keep up with the payments. So, if your income is $4,000 per month and your debts are $500, this would mean that you are currently at an approximate 13% debt to income ratio.

STEP 4: Calculating Your Mortgage Payments

These are some of the major costs a homebuyer faces when buying a home. Once you have all the costs figured out, you’ll want to sit down with your lender or loan officer to locate a realistic mortgage option.

These expenses include, but are not limited to:

Monthly mortgage payment: Principal, interest, taxes, homeowners insurance (PITI) and HOA dues (if applicable).

Homeowners Insurance

Homeowner’s insurance is required to obtain a mortgage. In fact, you’ll be paying for homeowner’s insurance before you even close on the property. Your lender will require that you pay your first year’s insurance premium when you close on your home loan, and it will be included in your monthly mortgage payment.

Homeowners insurance covers the structure of your home and your personal property inside, up to the policy limits. Most policies also cover liability and additional living expenses if something happens to your home.

For example, if a tree falls through your roof or an electrical fire damages half of your house and you can’t stay there for several months while it’s being repaired, homeowners insurance would cover the cost of temporary housing until your home is again habitable.

How much does homeowners insurance cost?

The typical homeowners policy costs between $1,000 to $5,000 per year, depending on where you live. Premiums vary based on factors like location, coverage limits and replacement cost value (RCV) as well as high risk areas for fire or natural disasters.

In general, if you have a $100,000 mortgage on a house that’s worth $550,000 (the value of the house is also called the replacement cost), your lender requires that you have at least $450,000 in liability coverage and $550,000 in coverage for the structure itself. In addition, you’ll want to protect any personal items inside the home with a rider or floater policy.

The more coverage you take out, the higher your premium will be.

Interest Rate

The two main variables that you will have to consider when determining how much you can afford are the loan amount and your interest rate.

Home loans are typically broken up into two types:

Fixed-rate mortgages have an interest rate that is set and does not change for the length of the loan. This provides stability, but if interest rates go down you will miss out on the lower rate. The most common fixed-rate mortgage is a 30-year loan.

Adjustable-rate mortgages (ARMs) start out with a low, fixed rate and then adjust upward or downward after a certain period of time, depending on market conditions at that time. Most ARM loans provide a fixed-rate payment for three to five years and then adjust every year thereafter.

These are also called 3/1 and 5/1 ARMs, which means they start with a fixed-rate and payment for five years, then adjust annually after that.

Private Mortgage Insurance (PMI):

If you do not have a 20% down payment to purchase the home, you will more than likely be subject to paying PMI. If so, this cost will be figured into your monthly mortgage payment.

You pay PMI as part of your monthly mortgage payment until you reach at least 20 percent equity in your home,, but there is no obligation for your lender to do so. This can take quite some time, especially in a rising real estate market where the value of the home increases faster than you can pay down your loan.

PMI can cost between 0.3% to 1% of the original loan amount on an annual basis. That means that if you borrowed $200,000, you may be paying as much as $2,000 a year — or around $167 per month — assuming a PMI rate of 1%.

There are different ways to eliminate mortgage insurance with less than 20% down; you can buy it out as a single premium, which is a lump sum at closing, or through an option called lender paid, which is a less common direction where you would have a higher interest rate that covers the cost of the premium.

Real Estate Taxes:

Real estate taxes are simply the taxes you pay for your home. All residential property requires the homeowner to pay property taxes – prices will vary from city-to-city, state-to-state.

Each town and county sets their own tax rate and the assessor determines the property value. This information is provided to you by your mortgage company, but you may also contact the local tax assessor’s office to confirm or to find out other important information.

Taxes may be paid annually, twice a year or quarterly. Most of the time when you put less than 20% down the lender will require you to include your taxes and insurance with your mortgage payment. In addition to property taxes, some municipalities also charge a municipal tax or supplemental tax – which is usually a fixed amount that doesn’t change year-to-year.

Down payment:

A down payment is required to purchase real estate. The down payment is subtracted from the purchase price of your home. Your mortgage loan will cover the rest of the price of the home.

The minimum amount you’ll need for your down payment depends on the purchase price of the home you’d like to buy and the type of mortgage.

Most conventional loans will require at least 20% down to obtain favorable terms and avoid private mortgage insurance (PMI) however many borrowers choose to only put 3-5% down in today’s market.

Some lenders offer special programs for buyers, however, which may lower the amount needed for a down payment. FHA loans, for example, may allow buyers to qualify with only 3.5% down if they have a credit score of 580 or higher. Down payment assistance programs may be available for buyers in certain areas who meet income qualifications.

In addition to the down payment, you will also need cash reserves on hand to cover closing costs and repairs that come up during the home inspection process.

Closing Costs:

In addition to a down payment, lenders and third parties associated with the transaction will charge fees to close the loan.

These fees may include loan origination fees, credit report fees, attorney fees, appraisal fees, underwriting fees, etc. In general, borrowers can expect to pay approximately 2-4% of the purchase price in closing costs.

While most of these closing costs must be paid by the borrower, some of them can be paid by the seller, split between buyer and seller or even credited by the lender. It is important that you ask your lender what costs are negotiable and which ones are non-negotiable before making an offer on a home.

Points:

Mortgage points are an upfront loan cost that could save money throughout the life of your loan. Mortgage points can be purchased in order to lower the overall interest rate on your loan. A lower interest rate means lower monthly payments as well as less money being paid over the life of the loan.

The cost of a point is 1% of your total loan amount. For example, if you’re borrowing $500,000 to buy a home, each point will cost you $5,000. Usually every 1% paid to buy the interest rate down equates to .25% in rate.

If you are planning on living your home for a long period of time and expect interest rates to rise, it can be a very wise idea to consider that is also typically a tax-deductible expense, of course consult with your accountant or tax professional the impacts to your taxes when you purchase a home.

Bonus Tips

It is always good to undershoot the number you can most afford. It is better to buy a cheaper house and to have extra money, than it is to overdo it and come up short.

Use a mortgage calculator to determine how much you can afford

Lenders tend to use a formula that is very complex to help decide how much a borrower is able to afford. By using a mortgage calculator you will be able to decide for yourself how much you can afford to pay by factoring in your income, debt, and other expenses to see if you qualify for a home loan.

You can start by calculating your gross income on a monthly basis. Then, you can use a mortgage calculator to determine how much house you can afford.

Here are a couple of sites that offer free calculators: Mortgagecalculator.org or Mortgagecalculator.net

These tools will allow prospective home buyers to get a good estimate as to what their monthly mortgage payments should be.

But be aware that this tool will only be able to give an estimated amount, so it would be wise to speak with a mortgage counselor to get concrete numbers.

Interest rates and guidelines may also vary from lender to lender, so it is always important to first shop around for the best deal before you make your purchase. And in the end, the mortgage lender will have the final say as to how much the monthly payment will be.

If you would like to know exactly how much mortgage you can afford, please call me at 619-379-8999 or email me at [email protected].

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Mar 29, 2022 | Mortgage Help |

If you do not have a 20% down payment to purchase the home, you will more than likely be subject to paying private mortgage insurance (PMI), which will be figured into your monthly mortgage payment.

PMI protects the lender in case you default on your loan and don’t have enough equity built up to sell the home and pay off the loan balance. Private mortgage insurers are for-profit companies that provide this protection for lenders.

Private mortgage insurance (PMI) is an extra mortgage cost that is used to cover the risk to a lender, and that is paid by a borrower in monthly premiums tied into their mortgage payments. It is not for the benefit of the borrower.

This type of insurance is usually required by lenders when a mortgage loan amount is above 80% loan to value (LTV) and the borrower has less than a 20% cash stake in the property. A loan amount above 80% is considered a lot riskier to lenders, and in order to cover this risk, they require insurance that will pay them in case the borrower defaults on the loan.

PMI payments range anywhere from 1% to as high as 1.5% of the loan amount that is amortized yearly and paid monthly throughout the life of their loan as long as the loan amount is above 80%.

For example, let’s say you get a $100,000 loan amount and are required to have mortgage insurance. Your estimated monthly insurance payments would be approximately $100 extra a month. A $200,000 loan amount would equate to approximately $200 a month in extra insurance fees.

As you can see, this money can add up quickly. Also, please keep in mind that this money does not help pay down the mortgage balance, and it is not tax-deductible.

You pay PMI as part of your monthly mortgage payment until you reach at least 20 percent equity in your home.

Because PMI exists for the benefit of the lender rather than the borrower, it would make perfect sense that most borrowers would be curious about either avoiding or canceling their PMI policies in order to save money on their monthly payments.

Although it is possible to eliminate the need to pay for PMI, the money required and process can be difficult for many people.

Here are a few ideas on how to avoid private mortgage insurance (PMI).

1. Make a 20% down payment

The most commonly known way to avoid private mortgage insurance altogether is to make a full 20% down payment when closing on your mortgage.

By putting 20% down, the lender knows you are a serious borrower who is placing a good chunk of money as a down-payment and they only have to extend an 80% loan, which makes it considerably less risky. This is also called an 80% loan to value.

Making anything below a 20% down payment automatically binds a borrower to a PMI plan.

However, having 20% down is easier said than done, and many borrowers are unable to meet this demand. This makes this specific method difficult for a lot of people.

2. Get a Second Mortgage

Another way to avoid the PMI policy would be to take on one of these funny-named loans, also known as “80-10-10” or “80-5-15” mortgages. The secret of this loan lies with the fact that it is actually two instead of one.

Although the thought of two separate loans on one mortgage plan might sound scary, they actually reduce the amount that you have to put down on a home while still avoiding PMI. Someone with just enough cash to make a 10% down payment is going to get a 90% mortgage and be stuck with a PMI premium.

Piggyback loans allow home buyers to take on one mortgage for 80% of the purchase price, and a second for 10% of the purchase price.

Under the program, the two loans make one mortgage at 90% of the purchase price, but act as two separate finance options. That 10% down payment under this program will suffice for the 80%-10%-10% plan, and could end up being even lower at 5% for the 80%-5%-15% plan.

Under this option, the 80% loan will not require PMI, and most lenders who hold this plan won’t require PMI under it due to the smaller lower-risk loans. Like everything else, piggybacks come with their downsides.

For example, the interest rate for the second loan will most likely be higher due to such a short term. While paying it off, you may end up paying a little extra in interest, all to save yourself from PMI.

3. Wait for your equity to rise above 20% loan to value

If you are currently paying mortgage insurance, the only way to cancel the insurance is to have more than 20% equity in your property. Some people will need to build equity over time if the housing markets allow them to eliminate their insurance policies. If your homes increase in value so you have 20% equity, then you can have the insurance canceled.

This will not happen automatically.

You have to call your mortgage servicers and have them review your mortgage and home value to assess if you can have the PMI requirement waived.

Important note:

Please keep in mind that mortgage insurance is not an insurance policy to protect you in case you miss your monthly mortgage payments, but for the lender only. If you fall behind on your monthly payments and you have this type of insurance, you can still lose your home to foreclosure.

It is your lender who would benefit from the insurance because they would still be paid in full even if you stopped making mortgage payments altogether and/or if you were foreclosed on.

To see if you’ll be paying PMI, you can start by talking to your loan officer about the details of your loan. They’ll be able to look at the specifics and let you know the amount you will be paying.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Nov 12, 2021 | Commerical Mortgage News, Foreclosure News |

In 2004, Donald Trump told CNN, “I love bad markets!”

In a Trump University audiobook, he had said “I sort of hope” the real estate market crashes.

“How you react to the so-called housing bubble can be a barometer of your business personality. Are you the type of person who takes advantage of positive situations when they present themselves…or do you heed every message of doom and gloom, avoiding risks that could be some remarkable opportunities?” he wrote in a 2005 post on his Trump University blog.

A couple of years later he told the Globe and Mail in March of 2007, “People have been talking about the end of the cycle for 12 years, and I’m excited if it is. “I’ve always made more money in bad markets than in good markets.”

A year before the last market crash of 2008, Trump counseled Trump University students to take advantage of the housing bubble as an investment opportunity. He was “excited” for it to end because of the money he’d make.

“The real estate markets crashed. Now, I don’t want to blame the real estate markets, because I always made a lot of money in bad markets. I love bad markets. You can do very well in a bad market,” he said.

Fast forward to 2020-2021, it looks painfully obvious that there is another commercial property crash that is rearing its ugly head all across the nation and the world.

The economic fallout from the COVID lockdowns forced thousands of companies around the U.S. to have their employees work from home, and many went out of business.

As a result, tens of thousands of commercial buildings sat empty for several months and some for over a year, forcing a severe financial burden on their cash-strapped owners. In addition, these owners had to pay their mortgage with virtually no tenants to help foot the bill, and as it turns out, many have not been able to make their payments for most of the time.

In April 2020, the Wall Street Journal reported, “A Reckoning Looms for Commercial Real Estate – and its Lenders”. The WSJ said;

“Even as Covid-19 cases surge world-wide, the arrival of viable vaccines holds the promise of a return to something resembling normality by the middle of next year. But the commercial real-estate sector may never get back to normal, and that could spell trouble for banks. Many banks are concentrated in and dependent on commercial property lending. Banks hold half of all commercial real-estate loans.

The 5,000 or so U.S. community banks, with about a third of total assets, are two to three times as concentrated in commercial real-estate lending as the approximately 30 larger banks. Problems in commercial real estate can hurt banks in two ways. Losses on existing loans can damage earnings directly, and a correction can reduce future lending volumes, impairing an important driver of earnings.

Based on what we know now, things don’t look good.”

Around the same time, a Politico magazine article said, “Commercial real estate is in trouble, and turbulence in the $15 trillion market is threatening to bleed over into the broader financial system just as the U.S. struggles to emerge from a recession.”

Politico reported, “The number of commercial loans that have been packaged into securities going into “special servicing” — where distressed loans are transferred to a new manager hired by bondholders to negotiate a payment plan on their behalf — has steadily increased since March.

“The number of commercial loans that have been packaged into securities going into “special servicing” — where distressed loans are transferred to a new manager hired by bondholders to negotiate a payment plan on their behalf — has steadily increased since March.

And it has become clear that the virus will continue to cut into revenue for some time, so even those property owners who have been able to patch together payments — thanks in part to now-lapsed relief measures passed by Congress — may start to slip.

The loss of paying tenants could touch off a wave of property write-downs and eventual foreclosures on everything from shopping centers to apartment buildings. But it’s not just a pocket of wealthy investors who will get hurt by widespread write-downs. Eighty-seven percent of public pension funds and 73 percent of private pension funds hold real estate investments.

For nearly two years now, many major commercial properties have suffered from low occupancy rates and forced closures due to the Covid-19 pandemic. This is especially true for Hotel properties with $100-200 million dollar mortgages that have remained virtually vacant throughout the crisis.

The facts are that many commercial building owners have not made payments over the last 1-2 years, and their lenders are starting to foreclose upon them for non-payment all across the nation. Investors hold up these loans via commercial mortgage-backed securities that have been bundled and sold on Wall Street all across the globe.

An economic disaster that I predict will become a market crash as soon as investors awake from their slumber and become wise to the media propaganda lying to their ears the whole time.

It has come time for many of them to pay the piper, and it is painfully obvious that many of these property owners barely have two nickels to scratch together. But they won’t tell you that. Quite the contrary.

Now, we will see the actual grave reality for what it is.

A commercial foreclosure crash like the world has never seen.

Major commercial markets like New York and especially Chicago are starting to surge as the foreclosure tsunami rises.

Here are the latest commercial foreclosure casualties. I’m sure Trump is more than ready to use his investing skills to snatch up some great deals in the years to come.

The big question is, “are you ready?”

Below is just a tiny example of the foreclosure fallout. There will undoubtedly be many more that will make this list as the months and years go by.

NEW YORK

Hello Living East Flatbush Apartment Complex

In New York, a judge ruled that Madison Realty Capital can go after the interests of the luxury commercial developer, Eli Karp’s Hello Living East Flatbush apartment complex — and the rest of its portfolio through a UCC foreclosure sale, according to The Real Deal.

Karp founded Hello Living in 2005. He has developed 10 buildings under and six more are allegedly in the pipeline.

Karp said in an interview that Madison “wiped him out” and forced him out of business.

“I can’t get around how this happened,” said Karp. “I have lost everything.”

A spokesperson for Madison said, “We are pleased with the court’s decisive final ruling in favor of Madison. The facts of this case speak for themselves. It is unfortunate that Mr. Karp has a pattern and practice of frivolous litigation against lenders and partners to further his agenda.”

The Kent House

The luxury mixed-use project, Williamsburg residential development Kent House is facing foreclosure auction thios past month for its equity interest in the luxury mixed-use project, at 187 Kent Avenue. The commercial property located at at 187 Kent Avenue has 96 apartments and 31,000 square feet of retail is owned CW Realty.

Invictus Real Estate Partners claimed that CW Realty defaulted on a $10 million mezzanine loan. The entity was created when Invictus Real Estate Partners took over the loan, along with a $78 million senior mortgage, from Prophet Mortgage Opportunity this summer, according to The Real Deal.

Invictus has also pursued foreclosure on the property based on the defaulted $78 million mortgage loan. To counter that, CW Realty on Sept. 17 filed a hardship declaration, a measure under the state’s commercial eviction and foreclosure moratorium to stop certain commercial real property mortgage foreclosure actions from moving forward until Jan. 15, 2022.

CHICAGO

Civic Opera House

The owner of the Civic Opera House commercial property was served with a $195 million foreclosure lawsuit representing the largest case of a downtown Chicago office building in years, according to Crain.

The lender, Wells Fargo’s lawsuit claims the New York investment firm founded by Mark Karasick failed to pay monthly loan payments on the Chicago’s Civic Opera House since May, marking the biggest default for a downtown office building since the pandemic.

601W and Berkley Properties owes $154 million on loans and $28.3 million for late payments on the 915,000-square-foot art deco landmark at 20 North Wacker Drive. The Cook County Circuit Court is expected to appoint real estate services firm Transwestern as the receiver next week.

The Loop

The owner of the Loop 226,000-square-foot office building in Chicago that houses a Morton’s Steakhouse handed the keys back to its lender to avoid foreclosure after failing to sell the property.

The Irish owned REIT, Wilton U.S. Commercial performed a deed in lieu of foreclosure of the 24-story Art Deco building at 65 East Wacker Place to Acres Capital rather than face a foreclosure lawsuit due to missed loan payments, Crain’s reported.

The REIT’s director Iain Finnegan said the building lost some non-profit tenants in the building “due to a lack of state funding” and the pandemic made it too difficult to recover, leaving the company with the choice to either restructure or sell the asset.

Wilton bought the building in 2010 for less than $16 million. The property had been seized by what is now CIBC through a foreclosure. After losing tenants over the years, Wilton struggled to cover the $1.3 million debt service payment in 2019 after generating less than $375,000.

Standard Hotel High Line

The owner of the luxury Standard Hotel High Line, the Hong Kong–based private-equity firm Gaw Capital hasn’t made a mortgage payment since May 2020, according to Crain’s.

The investment firm owes nearly $187 million, according to a foreclosure lawsuit filed recently in U.S. District Court in Manhattan.

Wells Fargo sent the owners a notice of default on their mortgage in June 2020 demanding demanded that Gaw Capital pay back the entire balance, but they failed to make payments for the next 17 months, the lawsuit says.

The loan backing the property is part of commercial mortgage-backed security or CMBS.

According to Curbed, “The 338-room hotel founded by André Balazs was purchased in 2017 by Gaw Capital, a Hong Kong–based private-equity firm led by Goodwin Gaw. Gaw bought the Standard for $340 million, $60 million less than it had been in contract for a few years before, and took out a $170 million acquisition loan from Natixis, a French investment bank that was bullish on hotels at a time when other lenders were pulling back.

“New York’s hospitality sector is a little out of favor at the moment,” Gaw told Forbes at the time. But during the last year and a half, the hospitality sector has fallen more than a little out of favor, with a global pandemic and travel bans making Airbnb and market oversaturation seem like relatively minor woes.

Gaw Capital owns several commercial properties across the country, mainly in San Francisco and the Standard Hotel High Line is its only New York City asset.

If you own shares in Gaw Capital, you may want to pull your money out soon because this news is a big red flag that they are in serious financial trouble.

Over the past year, several Manhattan hotels have permanently closed. The Roosevelt Hotel, which was owned by Pakistan’s national airline company, and the AKA Wall Street hotel, which has since been converted into apartments.

FLORIDA

DoubleTree Hotel by Hilton of Tallahassee

The Tallahassee DoubleTree Hotel by Hilton on Adams Street through his Delaware-based limited liability corporation, IB Tallahassee, LLC., a hotel owned by JT Burnette is going into foreclosure.

A Leon County court ruled on Sept. 24 that unless his company pays more than $32 million owed by the sale date, the property will go up for auction, which was scheduled to be auctioned on Oct. 28, and sold to a sucker buyer for $23 million.

Burnette was convicted on corruption charges earlier this year and will be sentenced in November 2021, according to ABC 27.

OHIO

Westin Cleveland Downtown

The Westin Cleveland Downtown is facing foreclosure but has found a sucker buyer to possibly buy the property. In later October, the owners through their attorney had asked a judge to approve the sale of the hotel to HEI Hotels & Resorts for $40.2 million, according to a motion and a copy of the agreement the lawyers for receiver Tim Collins filed in Cuyahoga County Common Pleas Court.

The Carew Tower

According to Cincinnati.com, the Carew Tower, one of Downtown’s most iconic buildings, is facing foreclosure and more than $642,000 in delinquent utility bills just over a year after the building was put up for sale.

Lender Veles Partners LLC filed a foreclosure lawsuit against the building’s owner, Greg Power, on Oct. 15 for defaulting on the mortgage, according to Hamilton County Common Pleas Court records.

Veles claims Power owed $9,664,656 in principal on the loan, about $93,630 in interest and $3,594 in late fees as of Oct. 5.

Power — a Downtown-based commercial real estate investor who owns the Carew Tower and the connected 561-room Hilton Cincinnati Netherland Plaza Hotel — was served a summons on Nov. 2.

OREGON

Loyd Center Mall

A New York-based real estate lending company says it plans to foreclose on the Lloyd Center mall and redevelop the beleaguered Northeast Portland shopping center.

According to Oregon Live, KKR Real Estate Finance Trust said it plans to take ownership of the 1.2 million square foot mall before the end of the year. The company says payments on its $110 million debt have been overdue since October 2020.

“Upon taking title, which is targeted for the fourth quarter, we’ll begin to plan for a comprehensive redevelopment of the site, which we expect will include multiple uses including residential and creative offices,” said Patrick Mattson, the president and chief operating officer of the company. Bloomberg Law first reported the comments.

KKR loaned $177 million toward a renovation of the Lloyd Center in 2015.

Lloyd Center opened in 1960 as a 100-store, open-air mall, said at the time to be the largest in the world. It was covered in the 1980s with a glass ceiling, then extensively renovated in the 1990s into a more traditional enclosed shopping mall with a central food court.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.

by Moe Bedard | Nov 8, 2021 | Foreclosure News |

There is a foreclosure crisis that is starting to surge across the nation. As soon as the government mortgage forbearance programs designed to help homeowners deal with the economic fallout of the Covid-19 pandemic expired, the grave reality of the current housing market has started to show.

Mortgage lenders have ramped up foreclosure filings with an increase in the third quarter of 68% nationwide compared to a year ago, according to a new report from the real estate analytical firm ATTOM.

Approximately 25,209 U.S. properties were at some stage in the foreclosure process in the third quarter of 2021, a 32% increase from the second quarter.

The report also showed there were a total of 19,609 properties with foreclosure filings in September 2021, up 24% from August and an increase of 102% from September 2020.

“Foreclosure starts are very likely to rise over the next six months to a year, with the increase ranging from a tick to a torrent,” says Todd Teta, chief product officer at ATTOM Solutions.

According to recent reports by Black Knight, forbearance volumes continue to decline, falling below 1.6 million in September. However, serious delinquent borrowers with more than 90 days behind are still roughly triple their pre-pandemic levels.

Approximately 1 million homeowners are currently in some stage of the forbearance program with their lender, and these people will most likely add to the foreclosure crisis once their agreement ends.

Lawrence Yun, the chief economist at the National Association of Realtors, had said, “The last time we saw this high of a level was back in 2008 and 2009 during the financial crisis. But what is different this time is that the foreclosure rate is at a historic low because of the forbearance program.”

In March, the U.S. government enacted The Emergency Mortgage Assistance Program, or EMAP, a $10 billion American Rescue Plan was set aside for housing assistance.

The U.S. Treasury has been approving state housing programs funded with Homeowner Assistance Fund relief. Arizona and Nevada have started mortgage assistance programs to deal with the crisis, and many more states are expected to announce their plans soon.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.