Energy-Efficient Mortgage (EEM): Make energy-saving improvements to your home

The Energy-Efficient Mortgage (EEM) program is designed to offer a financial incentive to homeowners who make energy-saving improvements to their homes.

The goal of the Energy-Efficient Mortgage program is to encourage homeownership while also promoting energy efficiency. Not only does this help the environment, but it also helps homeowners save on their utility bills each month.

The EEM is a special type of FHA loan that allows you to include the cost of energy-efficient upgrades into your mortgage. The cost of your energy improvements is added to your total mortgage amount, and you can still take advantage of the low down payments and credit score requirements offered by most FHA loans.

The EEM program allows homeowners to borrow money with no additional monthly costs, and the loan can be repaid when the house is sold.

The FHA EEM program is not a separate loan product — it’s an add-on to an existing FHA loan product. The EEM must be attached to a first lien 30-year fixe rate mortgage. The total cannot exceed 100 percent of the value of the property after improvements are made.

The borrower can receive up to $8,000 in down payment assistance (DPA) through an EEM.For example, if a borrower qualifies for an FHA loan with a 5% down payment, the maximum DPA they can receive is $4,000 ($8,000 x 5%).

The loan amount can be increased up to $3,500 for single family homes and $9,000 for multifamily homes (four units or less). This amount is determined by the lender and is based on the amount of the down payment required for the loan program and the household’s income.

You can also use an Energy-Efficient Mortgage if you’re refinancing an existing home, as long as the repairs are necessary to improve the health and safety of the property. You can also use an EEM if you are buying a new construction home and want to add energy-efficient features before moving in.

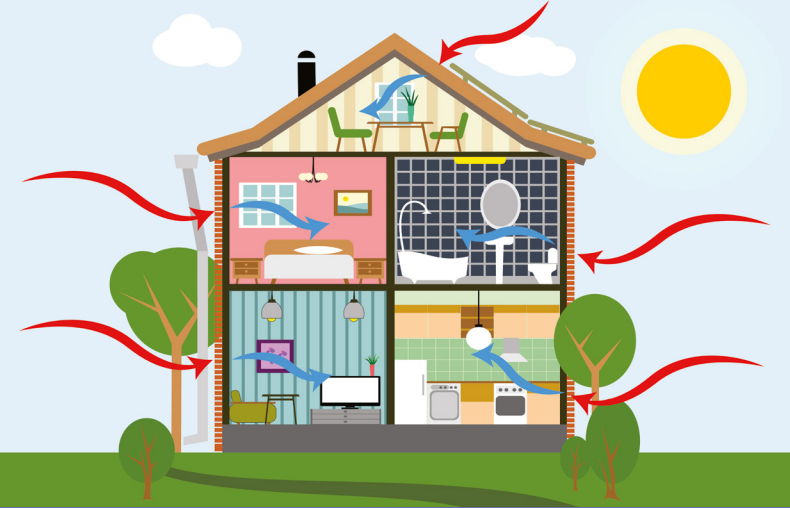

Energy efficiency improvements can include items such as solar panels, new windows and doors, insulation, and more. Disaster mitigation improvements include items such as flood-proofing and hurricane straps to reduce damage from floods or hurricanes.

To qualify for an EEM, you need to meet the following criteria:

Energy Audit – To qualify, homes must undergo an energy audit by a home inspector or contractor approved by the Department of Housing and Urban Development (HUD). The auditor checks the home’s insulation, appliances, lighting, and ventilation systems to see how efficient they are and determines whether they would benefit from upgrades.

The energy audit and report completed by a Home Energy Rating System (HERS) rater, who will determine the most cost-effective improvements to make and their estimated annual savings in utility costs.

The HERS rater provides this information on a label called a “home energy rating” that is used to estimate the property’s relative energy efficiency. After the audit, you get a list of suggested improvements and their costs.

FHA Loan

Your mortgage must be insured by FHA

Home Equity

You must have sufficient equity in your home to cover the cost of any work that is being done to make it more energy-efficient.

Valid Reason

You must have a valid reason for wanting to make these improvements, such as reducing your monthly utility bills or making it easier for someone with disabilities to live in your home.

The most common upgrades that qualify for an EEM include:

Solar panels

Insulation

Window replacements

Furnace replacements/upgrades

Water heater replacements

FHA’s maximum allowable insurable mortgage amount is 96.5% of the lower of the purchase price or appraised value plus the cost of any required repairs. If the borrower chooses to use an FHA EEM, it does not count against this limit.

All FHA programs with a down payment less than 20% or loan amounts above 80% loan to value require borrowers to pay mortgage insurance premiums (MIP).

This is an extra mortgage cost that is used to cover the risk to a lender, and that is paid by a borrower in monthly premiums tied into their mortgage payments. It is not for the benefit of the borrower.

This type of insurance is usually required by lenders when a mortgage loan amount is above 80% loan to value (LTV) and the borrower has less than a 20% cash stake in the property.

PMI payments range anywhere from 1% to as high as 1.5% of the loan amount that is amortized yearly and paid monthly throughout the life of their loan as long as the loan amount is above 80%, so you should factor this into your budget when deciding whether an Energy-Efficient Mortgage is right for you.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.