If you are unable to pay your mortgage, refinance, or get a loan modification, you may be able to qualify for what is called a “deed in lieu of foreclosure.”

A deed in lieu of foreclosure (DIL) is a legal procedure in which you willingly transfer your property’s title (deed) back to the lender.

In return, the lender agrees to release you from all legal obligations to the mortgage contract. This will be done to satisfy a defaulted loan and to prevent foreclosure proceedings.

A DIL is often better than just walking away from your home and letting it fall into foreclosure because it has a less detrimental effect on your credit score.

You can also negotiate with your lender so that they will not legally come after you to collect any money you may owe on the mortgage in back payments and fees after the lender has sold the property.

On the other hand, a deed in lieu is also beneficial for the lender because it avoids the costs and effort required for a foreclosure sale.

What are the elegibility requirements?

You may qualify for a DIL but let me warn you that this is not an easy process. Before your mortgage servicer even considers this option, you must meet specific elegilibility requirements;

- You cannot afford your current monthly mortgage payments

- The property must be your primary residence, not an abandoned or investment property.

- You’re experiencing financial hardship, such as losing your job, reduced income, significant illness, divorce, or another difficulty.

- You’re unable to obtain a loan modification and have exhausted all other loan workout options and financial resources available to you.

- You tried to sell your property with a licensed real estate brokerage at fair market value for at least 90-120 days but were unsuccessful

- You don’t wish to stay in your house due to other circumstances, such as a job relocation

- You must have actively explored and exhausted all other options and financial resources available to you.

How do I get a deed in lieu of foreclosure from my lender?

In general, a deed is a right granted by a legal contract based upon mutual agreement; therefore, a deed-in-lieu must be based upon voluntary agreement in good faith.

To proceed with a deed in lieu, both parties must agree to and sign both an Agreement in Lieu of Foreclosure, which outlines the terms of the deed and the deed itself, which transfers legal ownership of the property.

For the agreement to be reached, the property’s appraised market value must be less than the original agreement’s outstanding debt, and the property must not be subject to any 3rd party creditor claims or liens.

A third party escrow service then executes the legal agreement, which will release both you and the lender from the original contract.

Once the agreements are reached and there a clear title, the lender then classifies the original loan as paid and issues a waiver to a deficiency judgment. This will typically go into effect if the property’s sale results in less than what is owed on the debt.

Please be advised that many lenders may not be amenable to a deed in lieu because they believe they will have a better title after a standard foreclosure sale. This is because a trustee’s deed of sale effectively erases any judgment liens and second and third mortgages after a foreclosure. Thus, it would depend on the borrower’s lender whether they will accept a deed in lieu or not.

How will it affect my credit?

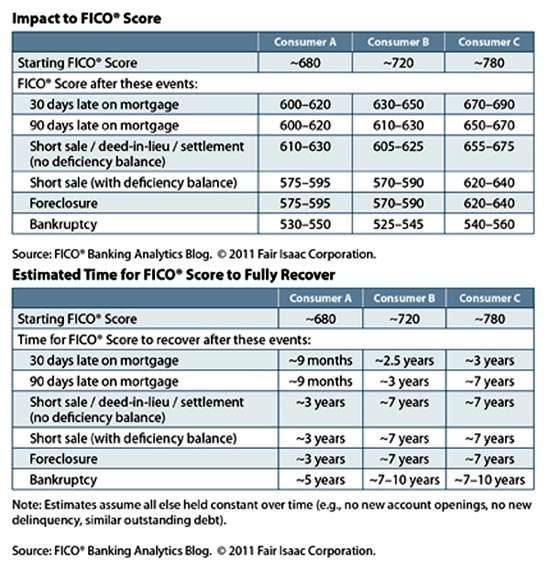

A deed in lieu of foreclosure will cause a negative impact on your credit score. According to a 2011 FICO study, if you begin with a score of approximately 720, it will drop 105 to 125 points off your score; but if you start with a score of 680, you’ll lose 50 to 70 points. But please be aware that your score will drop a lot more if there is any deficiency balance owed.

Here are the charts from FICO;

With that said, you can expect to lose from 50 points minimum to 250 or more points depending on your credit score when you started and if you own a deficiency balance or not. The credit report will also reflect the deed in lieu for seven years, although a borrower can still rebuild their credit.

However, the ill effect on the credit score gradually lessens in time, and you may request its removal from a credit report towards the closing of year seven.

Tax Consequences

Please be aware that if you can complete a deed in lieu of foreclosure, you will still be liable for taxation on the cancellation of indebtedness or COD income. The tax results would be based on whether the loan is classified as a non-recourse loan or a recourse loan.

You can find out if your loan is recourse or non-recourse in your original loan documents that were initially signed by the lender and borrower.

A, if the basic rule of thumb is that if a lender’s only option is to take possession of the property when the borrower defaults, it is a non-recourse loan. However, if the lender can go after the borrower to collect any shortfall when the property is sold, then it is a recourse loan.

A lender will submit a Form 1099-C to the IRS in the case of a shortfall. This is known as the borrower’s COD income.

In the case of a non-recourse loan, the IRS will consider the deed’s tax consequences in lieu as if the borrower had sold the property. If the property’s current market value is less than what is owed, the borrower will have a personal loss, but this is not tax-deductible.

On the other hand, if the property’s value is greater than the outstanding loan, the borrower will have a gain that may not be taxed if he is able to comply with IRS Sec. 121 two-year residency requirement. In the case of a recourse loan, the situation is similar to the non-recourse loan except that the borrower will also be taxed for COD income if the property’s value is less than what is owed. Ordinary income rates will be applied for the COD income.

According to the IRS, the amount of the benefit must be reported as income received under IRC §61(a)(11)3, unless the taxpayer qualifies for an income exclusion under IRC §108.

When can I buy another home?

Most lenders will not offer a loan to a borrower who has filed a deed in lieu for a minimum of two to three years since it will significantly bring down your credit score. The chances of loan approval increase after a few years, especially if a borrower attempts to rebuild their credit score.

But please be aware that some alternative lenders may extend a mortgage to borrowers who maintain good credit score (680 and above) with large down payments in the 25-30% range.

Generally speaking, you will have to wait after a few years as passed and new credit has been established to purchase a home once more.

Moe Bedard is the founder and lead mortgage analyst for LoanSafe.org. Since 2007, LoanSafe has helped over 2 million consumers with solutions to their mortgage problems and has been featured in the New York Times, LA Times, Fox Business, and many other media publications.