by Moe Bedard | Apr 12, 2022 | Mortgage Rate News |

Mortgage interest rates go up and down daily, sometimes hourly. A rate lock means that the interest rate won’t fluctuate from what you were offered and closing.

As mortgage rates rise, borrowers are opting to lock their rates during the underwriting process rather than gamble with uncertainty.

The number of people locking their rates went up 19.1% month over month for March, according to the latest report from Black Knight.

Black Knight said the increase was driven by a 31% increase in purchase volume, which is now up nearly 70% over the past three months.

The cash-out refinance share of the market remained flat in March, which was 1.6%. The rate/term refinance drops continued, and the market share is now down to 28%.

That’s the lowest since November 2018. Non-conforming loan products are gaining ground, too, as their pace of growth for home prices has reached record highs.

According to Scott Happ. president of Optimal Blue, a division of Black Knight;

“Mortgage interest rates spiked in March, with 30-year offerings climbing 70 basis points over the course of the month.

In fact, our OBMMI (Optimal Blue Mortgage Market Indices) daily interest rate tracker showed the average 30-year conforming rate reach as high as 4.93% late in the month before pulling back slightly to close out March at 4.79%,” he said.

“As home prices continue to climb — even in the face of sharply rising interest rates — we’ve seen the average loan amount rise as well.

The average loan rose by $8,000 to just under $362,000 in March, representing a more than 23% increase over February’s rise,” Happ said.

by Moe Bedard | Apr 11, 2022 | Mortgage News from LoanSafe.org |

Mortgage delinquencies are on the rise, and our national delinquency rate has just risen for the first time in 9 months, according to the latest report from Black Knight.

The number of properties that are 60 or more days past due or in foreclosure reached over 1 million nationwide, and foreclosure starts have increased 541% from the same time last year.

Nationwide, there are 1.95 million properties with more than 30 days of delinquency.

A contributing factor to this was a 97,000 increase in early-stage delinquencies. This is when a property is either 30-60 days past due or in foreclosure.

The number of homes in serious delinquency — 90 days or more past due — dipped slightly by about 2,000 loans, but remained at the highest level since 2013.

The largest increases in delinquencies were seen in the Northeast U.S., where rates climbed by 5%, and in the Midwest, where rates increased by 4%. In contrast, mortgage delinquencies fell by approximately 14% in the West and by 1% in the South.

The largest month-over-month increase in two years occurred in the Northeast, and it’s largely driven by the hardest-hit states, including New York, New Jersey and Connecticut.

For example, in New Jersey, early stage delinquencies rose by 56%, and in New York, the rate was up 42%, compared to last year. Connecticut had a 36% increase in early-stage delinquencies.

Black Knight explained that the increase in early-stage delinquencies was driven primarily by “a sharp uptick” among loans that were current just three months ago — particularly those with an initial six-month payment deferral.

by Moe Bedard | Apr 10, 2022 | Mortgage News from LoanSafe.org |

Elon Musk is a well-known entrepreneur and billionaire who is best known for his roles in Tesla and SpaceX.

He has plenty of money, but recently he took out several very large mortgages on five properties in California.

When he borrowed this money, Musk faced some big decisions about which type of loans to go with. There are two options: fixed-rate mortgages or adjustable mortgages.

Fixed-rate mortgages provide the borrower with a guarantee of stable monthly payments.

Adjustable mortgages don’t offer that same benefit, but they do come with substantially lower rates.

Musk chose to take a big risk with his mortgage loans.

Instead of choosing a 30-year fixed-rate mortgage – which would have given him stable monthly payments – Musk chose a hybrid-adjustable loan (ARM).

The Tesla CEO, 49, took out several mortgages worth more than $61 million to buy five adjacent homes in the posh Bel-Air neighborhood of Los Angeles where celebrities like Jennifer Aniston and Kim Kardashian live, according to property records reviewed by Business Insider.

He bought two of the houses – which are located near one another in Bel Air – in 2012 and 2013 for $17 million and $6.75 million, respectively.

Musk bought one of the houses from actor Gene Wilder for $6.75 million, and another from actress Talia Shire for $6.4 million. The other three are located in the Hidden Hills neighborhood of Los Angeles and cost him $24 million combined.

For his new mortgages, Musk secured a floating rate loan with a 3% interest rate for the first six months, which will then increase to 4.5%, according to property records filed with the county recorder’s offices for Los Angeles County, San Mateo County and Alameda County in California.

The loans total $24.6 million from Citibank and $36.3 million from Morgan Stanley.

Musk was able to borrow a high-risk mortgage because he’s a billionaire.

With his wealth, he could afford to take a chance with an ARM mortgage and see his rates go up and payments rise if and when that would happen.

Musk was unlikely to find himself in a position where he couldn’t refinance his loan if needed, especially given his personal wealth and long-established borrowing relationships with major banks.

The typical borrower, however, might not be so equipped to bear the risk of an adjustable-rate mortgage.

The average person would likely find themselves in serious financial hardship if their rates rose — and there’s a good chance they will continue to do so in the forseable future.

by Moe Bedard | Apr 7, 2022 | Mortgage News from LoanSafe.org |

Rising mortgage rates on FHA loans are driving up monthly payments, making it harder for many to afford.

FHA loans have long been touted as one of the most effective ways for first-time homebuyers to get a mortgage. But with rising interest rates — and a lingering threat of more — FHA borrowers are about to face more pain.

For home buyers, the difference between qualifying for a 3.5% down FHA loan and a 5% conventional loan is significant: about $150 per month on a median-priced home in the U.S., according to one analysis from mortgage data provider CoreLogic.

For people who already have a FHA loan, borrowers will likely see their monthly payments increase due to higher interest rates, which could hurt their financial situation if they don’t have other income streams coming in or an emergency fund set aside in case they lose their job.

If you purchased your home a few years ago, or even just last year when rates were at historic lows, you might be surprised to learn how much higher the rate is today.

The average 30-year rate on FHA-backed loans has risen from 3.97 percent in January to 4.68 percent as of this writing, according to data provided by Ellie Mae, an industry software provider.

That’s a rise of 0.71 percentage points in just six months, and it translates into higher payments for all new FHA borrowers:

$1,429 monthly on a $200,000 loan — an increase of $160 monthly or $1,920 annually

$2,073 monthly on a $300,000 loan — an increase of $239 monthly or $2,868 annually

$2,888 monthly on a $400,000 loan — an increase of $328 monthly or $3,936 annually

Each 1-percentage-point increase in mortgage rates is equivalent to a 10 percent drop in home affordability, according to Trulia.

“FHA buyers are going to get squeezed,” said Jed Kolko, chief economist at Trulia. “They’re going to have higher house payments.”

The rate spike isn’t the only problem facing borrowers with FHA loans right now. Insurance premiums are also expected to rise in coming years — and those increases will hit people who took out their mortgages before the hikes were announced.

The average interest rate on 30-year fixed-rate mortgages increased from 4.20% in March to 4.37% in April, according to mortgage finance agency Freddie Mac (FMCC).

Meanwhile, the average rate on 15-year fixed-rate mortgages rose from 3.43% in March to 3.57% in April.

Just a few months earlier, rates were hovering around 3.5 percent. Homeowners with ARMs are also feeling the pain of higher rates, though the impact will be somewhat less immediate.

The reason for the increase is simple: The Federal Reserve has been raising short-term interest rates as the economy improves and unemployment levels drop.

It’s also winding down its monthly bond purchases that have kept mortgage rates at historic lows.

by Moe Bedard | Apr 4, 2022 | Mortgage News from LoanSafe.org |

A new Redfin report says the rush to purchase second homes dropped in February to its lowest level since May 2020. Though demand is still up 35% above pre-pandemic levels, the vacation housing market will cool as rates rise.

The Redfin report shows that vacation home purchases dropped 38% year-over-year in February after falling 34% in January and 27% in December. The drop comes as the cost of borrowing rose at an accelerated pace following an increase in Treasury yields due to rising inflation expectations, soaring government debt issuance, and ongoing fears related to the COVID-19 pandemic.

Over the last couple of years, affluent homebuyers have been snapping up vacation properties at an unprecedented rate amid the pandemic and remote work flexibility. Many are moving out of cities and into suburbs and smaller cities or greener pastures in states with lower taxes and a more reasonable cost of living.

Before the pandemic, demand for second and primary homes grew at similar rates. But pandemic lockdowns and the Federal Reserve’s easiest monetary policies on record, coupled with FOMO and low inventory, unleashed a surge in buying panic in beach towns and mountain areas.

Upscale housing markets in Phoenix and Las Vegas saw double-digit increases in demand for luxury vacation homes this past winter compared with a year earlier as snowbirds flocked to warmer climates for COVID-19 respite and remote work escape options during the pandemic lockdowns.

But as rates rise, the market is more unaffordable to potential second home buyers.

Redfin found that demand for vacation homes declined 7% in February compared to January. The percentage of vacation home searches fell from 7% of all searches in mid-January to 5% at the end of February, “a bigger drop than we saw after last year’s election,” said Daryl Fairweather, Redfin’s chief economist.

“With mortgage rates now over 3%, they are starting to affect buyers’ decisions,” Fairweather added. “The slowdown in vacation home searches is a sign that it may be getting harder for many Americans to afford a second home.”

Mortgage rates on vacation homes have risen to 3.37% from 2.88% in January. A 30-year fixed-rate mortgage for a home purchase is now at 3.12%, the highest rate since July 2020.

The report says: “As interest rates climb toward 3%, that market is going to cool off. Affordability has been bolstered by historically low mortgage rates for much of the past year and a half. As those low rates start to disappear, we could see buying power dip and affordability decline once again. But there will be more sellers on the market this spring and summer than last year, which will help offset some of those effects on affordability.”

“With mortgage rates on an upward trajectory again, it’s likely we’ll see a drop in demand as people reassess what they can afford,” said Taylor Marr, senior economist at Redfin. “The future of the vacation home market will depend on how long mortgage rates stay elevated and if there is another round of stimulus that boosts buyers’ confidence.”

“Vacation home buyers have the most urgency about locking in low rates,” Redfin agent Kathleen Plinske said in a statement. “They’re generally wealthier, more stable and more risk averse than people looking for primary homes.”

by Moe Bedard | Apr 3, 2022 | Mortgage Assistance Programs |

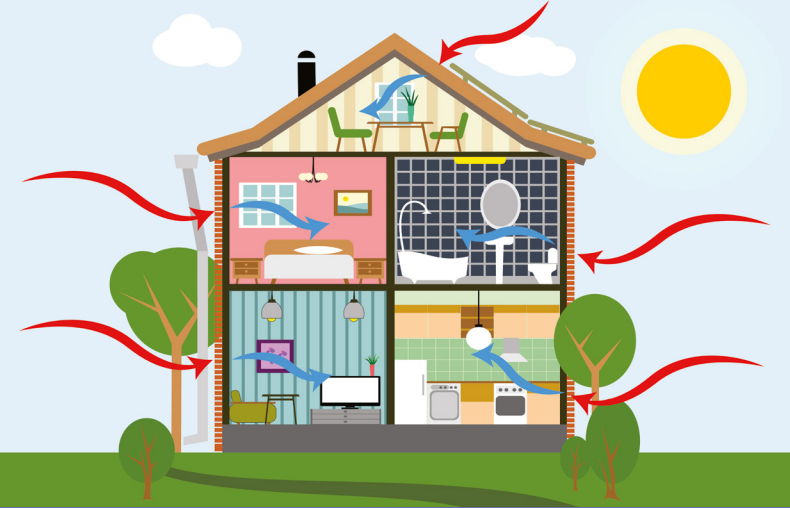

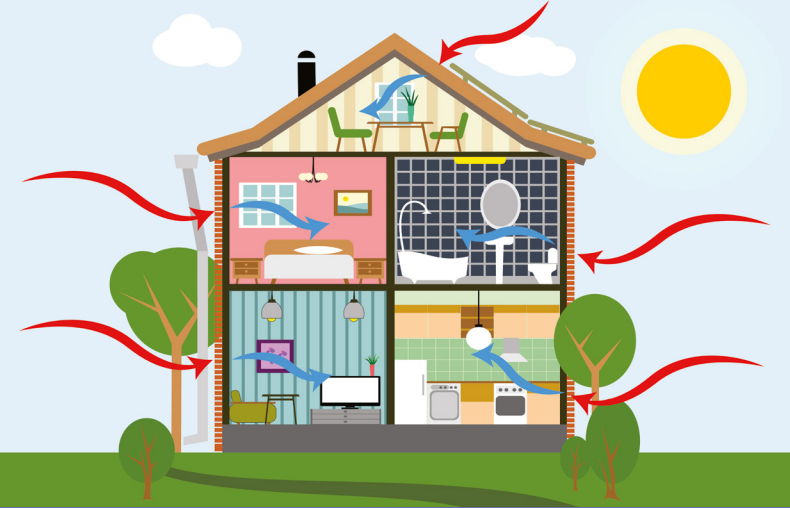

The Energy-Efficient Mortgage (EEM) program is designed to offer a financial incentive to homeowners who make energy-saving improvements to their homes.

The goal of the Energy-Efficient Mortgage program is to encourage homeownership while also promoting energy efficiency. Not only does this help the environment, but it also helps homeowners save on their utility bills each month.

The EEM is a special type of FHA loan that allows you to include the cost of energy-efficient upgrades into your mortgage. The cost of your energy improvements is added to your total mortgage amount, and you can still take advantage of the low down payments and credit score requirements offered by most FHA loans.

The EEM program allows homeowners to borrow money with no additional monthly costs, and the loan can be repaid when the house is sold.

The FHA EEM program is not a separate loan product — it’s an add-on to an existing FHA loan product. The EEM must be attached to a first lien 30-year fixe rate mortgage. The total cannot exceed 100 percent of the value of the property after improvements are made.

The borrower can receive up to $8,000 in down payment assistance (DPA) through an EEM.For example, if a borrower qualifies for an FHA loan with a 5% down payment, the maximum DPA they can receive is $4,000 ($8,000 x 5%).

The loan amount can be increased up to $3,500 for single family homes and $9,000 for multifamily homes (four units or less). This amount is determined by the lender and is based on the amount of the down payment required for the loan program and the household’s income.

You can also use an Energy-Efficient Mortgage if you’re refinancing an existing home, as long as the repairs are necessary to improve the health and safety of the property. You can also use an EEM if you are buying a new construction home and want to add energy-efficient features before moving in.

Energy efficiency improvements can include items such as solar panels, new windows and doors, insulation, and more. Disaster mitigation improvements include items such as flood-proofing and hurricane straps to reduce damage from floods or hurricanes.

To qualify for an EEM, you need to meet the following criteria:

Energy Audit – To qualify, homes must undergo an energy audit by a home inspector or contractor approved by the Department of Housing and Urban Development (HUD). The auditor checks the home’s insulation, appliances, lighting, and ventilation systems to see how efficient they are and determines whether they would benefit from upgrades.

The energy audit and report completed by a Home Energy Rating System (HERS) rater, who will determine the most cost-effective improvements to make and their estimated annual savings in utility costs.

The HERS rater provides this information on a label called a “home energy rating” that is used to estimate the property’s relative energy efficiency. After the audit, you get a list of suggested improvements and their costs.

FHA Loan

Your mortgage must be insured by FHA

Home Equity

You must have sufficient equity in your home to cover the cost of any work that is being done to make it more energy-efficient.

Valid Reason

You must have a valid reason for wanting to make these improvements, such as reducing your monthly utility bills or making it easier for someone with disabilities to live in your home.

The most common upgrades that qualify for an EEM include:

Solar panels

Insulation

Window replacements

Furnace replacements/upgrades

Water heater replacements

FHA’s maximum allowable insurable mortgage amount is 96.5% of the lower of the purchase price or appraised value plus the cost of any required repairs. If the borrower chooses to use an FHA EEM, it does not count against this limit.

All FHA programs with a down payment less than 20% or loan amounts above 80% loan to value require borrowers to pay mortgage insurance premiums (MIP).

This is an extra mortgage cost that is used to cover the risk to a lender, and that is paid by a borrower in monthly premiums tied into their mortgage payments. It is not for the benefit of the borrower.

This type of insurance is usually required by lenders when a mortgage loan amount is above 80% loan to value (LTV) and the borrower has less than a 20% cash stake in the property.

PMI payments range anywhere from 1% to as high as 1.5% of the loan amount that is amortized yearly and paid monthly throughout the life of their loan as long as the loan amount is above 80%, so you should factor this into your budget when deciding whether an Energy-Efficient Mortgage is right for you.

by Moe Bedard | Apr 3, 2022 | Mortgage Rate News |

U.S. mortgage rates jumped again this week, according to Freddie Mac’s Primary Mortgage Market Survey of April 1st. The 30-year fixed-rate mortgage rose to 3.29% from 3.21% last week and 4.07% a year ago; the 15-year fixed rate moved up to 2.61% from 2.57% and 3.26%, respectively; and the 5-year ARM rate averaged 2.77%.

The U.S. economic recovery has been fueled by record-low mortgage rates and stimulus checks from the government to help support households during the pandemic. This led to a strong housing market with a balance of supply and demand, said Sam Khater, Chief Economist at Freddie Mac, in a statement accompanying this week’s survey results.

“Mortgage rates are now at the highest level since June 2020,” he added. “While the rise in rates will likely put some pressure on home sales going forward, we expect existing sales to remain close to 20-year highs.”

However, as rates continue to rise and new stimulus checks remain uncertain, economists expect the pace of home sales to slow down in 2021, as buyers are no longer able to afford as much house as they could before.

“The current Fed and Treasury policies have been effective (up until now) in driving down mortgage interest rates and stimulating credit demand by both consumers and businesses alike,” said Jim Baird, chief investment officer at Plante Moran Financial Advisors.

“That said, policy makers are clearly concerned about rising inflationary pressures which could potentially derail an already fragile recovery given the enormous amount of federal support currently in place.”

According to Freddie Mac’s report, “With vaccinations ramping up and fears of COVID-19 receding, more consumers are out shopping for homes, which is pushing prices higher while putting pressure on affordability.

In addition, the supply of homes remains tight as many homeowners who would be selling their homes are opting to stay put due to low inventory.”

by Moe Bedard | Apr 1, 2022 | Mortgage Help |

Figuring out how much mortgage you can afford is a process that involves several steps. Once you have gone through all of them and have thoroughly examined your financial situation, you can have a much better idea as to how big of a loan you can afford, and in turn, how big of a house to look for.

The general rule of thumb is that about a third of a borrower’s income should be dedicated to financing a home. For example, if someone makes an annual salary of $50,000 a year, they should be able to manage a mortgage of $150,000 if their current debt is moderate.

While this tends to be a common rule for some, it will not be the case for every new home buyer.

A good rule of thumb is to examine your current debt, living expenses, and then adjust for future financial obligations, like children, education, and possible retirement.

Instead of trying to spend all your earnings on buying a home, a more modest approach is sometimes necessary. There’s no better way to be well-prepared for homeownership than making a budget and sticking to it!

Aside from considering your regular monthly costs such as utility bills, car insurance, health insurance, etc. – finding out the exact mortgage costs you will be facing will help you determine whether or not the purchase is a sound financial investment.

You also need to keep in mind that a mortgage loan pays not just for your house, but also for the costs of owning a home, such as insurance, property taxes, and home maintenance. All of these things should be factored into your calculations when you are calculating your mortgage.

There are also many more factors such as your interest rate, credit score, debt-to-income ratios and down payment that affect the amount you can afford to borrow.

The best way to determine exactly what fees you’ll pay is to find a lender and pre-qualify for a mortgage. This process will allow a borrower to receive a loan estimate from the lender, which will have all of the exact costs associated with the mortgage.

Below I will discuss the steps and most effective ways for an individual to calculate how much they can realistically afford.

* If you need to quickly see how much mortgage you can afford and you do not want to read this entire article, please call me at 619-379-8999 or email me at [email protected].

STEP 1: Calculate Your Monthly Income

To qualify for a mortgage, you and your spouse must prove that you have enough income to cover all of your housing costs, including homeowner association dues and property taxes.

You should also add up all sources of your monthly income, including your spouse’s if you are married, alimony if you are getting some and any other income that you receive.

If you have a fixed-term employment contract or receive a salary from your job, then the calculation is easy. Just add up all of your monthly income and divide it by 12 to get the average amount of money you make each month.

Gross monthly income is the total amount of money earned before any deductions have been made. For example, if you make $45,000 per year and work 40 hours per week, then your gross monthly income is $3,750 ($45,000 divided by 12 months).

If your spouse earns $50,000 per year and works full-time. Her gross monthly income is $4,167 ($50,000 divided by 12 months). Adding these two together gives you a gross monthly income of $7,917 ($3,750 + $4,167).

If you receive variable or irregular income from self-employment, there are several things that you can do. For example, let’s say that you are self-employed and your income varies from month to month or year to year due to market conditions or seasonal factors.

To account for this in the calculation of your monthly income for mortgage purposes, simply average out the last 2 years of your income tax returns and use this figure as your monthly income when applying for a mortgage. These calculations can, however, be slightly tricky because some of the deductions on your tax return are added back into your net income like depreciation, depletion and one-time expenses/repairs.

If you were getting alimony every month or had another source of income such as an investment property, then include that as well. Also include any investments in stocks and bonds or annuities (regular payments) as well as any government benefits.

If you receive Social Security, Alimony, Child Support or any other income source that is Non-Taxable a lender may be able to qualify 25% above what you receive which will allow you to qualify for a slightly higher purchase price/loan if needed.

STEP 2: Calculate Your Monthly Expenses

In addition to this information about your monthly income, lenders will also want to know about your existing debts. This includes credit card debt and any other type of installment loans that you carry each month.

Lenders will take the sum of these debts and add it to your estimated mortgage payment to see if you have enough room in your budget before approving your loan application.

This will include any rent or mortgage, food, transportation, taxes, insurance, and other regular costs of living such as your car payment, credit card payments, utility bills, and other recurring costs.

STEP 3: Debt-to-Income Ratios

Mortgage lenders look at your gross monthly income and your monthly debts to determine how much of a mortgage loan you can afford. This is called the debt-to-income ratio.

Debt to income ratio applies to the comparison of an individuals monthly expenses to their monthly income. Lenders use strict debt-to income ratios when qualifying a borrower for a mortgage, so it is imperative that you get a basic understanding of how this is done.

The housing to payment ratio is referred to as your front-end debt-to-income (DTI) ratio and includes all expenses associated with the mortgage – including principal, interest, property taxes and homeowners insurance. To calculate an affordable front-end DTI, multiply 0.3 by your gross (pretax) annual income, then divide by 12.

In contrast, your back-end DTI is the percentage of your gross monthly income that is applied to all other installment debts (i.e., mortgages, student loans, car payments, credit cards, child support etc). One of the first things to do is itemize all of your debts, including credit card bills, personal loans, and car payments.

The back-end DTI shows the lender exactly how much of your earnings go towards your total debt obligations. Generally, they will look for a borrower with a DTI of around 43-55%. If your DTI is below 43% then you have a better chance of qualifying for a loan.

If your DTI is above 43% then you may have a more difficult time meeting the requirements. FHA mortgages allow a higher number with a front-end DTI of 47% of your gross monthly earnings, and a back-end DTI of 57-59%.

How to calculate your debt to income ratio (DTI)

To determine the size of a mortgage you can afford, your total monthly payment, taxes and insurance (PITI) should not exceed 2x to 2.5x your take-home pay or salary after taxes and other withholding are taken into consideration.

The first step is to calculate your gross monthly income.

To do this, simply figure out how much money you are making each month from all of your documentable sources throughout the year and now divide that by 12. If you are married, figure both incomes into the equation.

Remember I said “documentable”.

If you can’t prove it, it didn’t go into your bank account and or you do not claim it on your taxes, then it is not provable income.

Add up all your monthly debts

Things like a car, credit cards, and stuff that will show up on your credit report are what we are looking for. Figure out what percentage of your income is going towards paying off debts. Generally, figures like 5%, 10%, or 20% are used.

Of course, the lower the better, as you will be more likely to be able to keep up with the payments. So, if your income is $4,000 per month and your debts are $500, this would mean that you are currently at an approximate 13% debt to income ratio.

STEP 4: Calculating Your Mortgage Payments

These are some of the major costs a homebuyer faces when buying a home. Once you have all the costs figured out, you’ll want to sit down with your lender or loan officer to locate a realistic mortgage option.

These expenses include, but are not limited to:

Monthly mortgage payment: Principal, interest, taxes, homeowners insurance (PITI) and HOA dues (if applicable).

Homeowners Insurance

Homeowner’s insurance is required to obtain a mortgage. In fact, you’ll be paying for homeowner’s insurance before you even close on the property. Your lender will require that you pay your first year’s insurance premium when you close on your home loan, and it will be included in your monthly mortgage payment.

Homeowners insurance covers the structure of your home and your personal property inside, up to the policy limits. Most policies also cover liability and additional living expenses if something happens to your home.

For example, if a tree falls through your roof or an electrical fire damages half of your house and you can’t stay there for several months while it’s being repaired, homeowners insurance would cover the cost of temporary housing until your home is again habitable.

How much does homeowners insurance cost?

The typical homeowners policy costs between $1,000 to $5,000 per year, depending on where you live. Premiums vary based on factors like location, coverage limits and replacement cost value (RCV) as well as high risk areas for fire or natural disasters.

In general, if you have a $100,000 mortgage on a house that’s worth $550,000 (the value of the house is also called the replacement cost), your lender requires that you have at least $450,000 in liability coverage and $550,000 in coverage for the structure itself. In addition, you’ll want to protect any personal items inside the home with a rider or floater policy.

The more coverage you take out, the higher your premium will be.

Interest Rate

The two main variables that you will have to consider when determining how much you can afford are the loan amount and your interest rate.

Home loans are typically broken up into two types:

Fixed-rate mortgages have an interest rate that is set and does not change for the length of the loan. This provides stability, but if interest rates go down you will miss out on the lower rate. The most common fixed-rate mortgage is a 30-year loan.

Adjustable-rate mortgages (ARMs) start out with a low, fixed rate and then adjust upward or downward after a certain period of time, depending on market conditions at that time. Most ARM loans provide a fixed-rate payment for three to five years and then adjust every year thereafter.

These are also called 3/1 and 5/1 ARMs, which means they start with a fixed-rate and payment for five years, then adjust annually after that.

Private Mortgage Insurance (PMI):

If you do not have a 20% down payment to purchase the home, you will more than likely be subject to paying PMI. If so, this cost will be figured into your monthly mortgage payment.

You pay PMI as part of your monthly mortgage payment until you reach at least 20 percent equity in your home,, but there is no obligation for your lender to do so. This can take quite some time, especially in a rising real estate market where the value of the home increases faster than you can pay down your loan.

PMI can cost between 0.3% to 1% of the original loan amount on an annual basis. That means that if you borrowed $200,000, you may be paying as much as $2,000 a year — or around $167 per month — assuming a PMI rate of 1%.

There are different ways to eliminate mortgage insurance with less than 20% down; you can buy it out as a single premium, which is a lump sum at closing, or through an option called lender paid, which is a less common direction where you would have a higher interest rate that covers the cost of the premium.

Real Estate Taxes:

Real estate taxes are simply the taxes you pay for your home. All residential property requires the homeowner to pay property taxes – prices will vary from city-to-city, state-to-state.

Each town and county sets their own tax rate and the assessor determines the property value. This information is provided to you by your mortgage company, but you may also contact the local tax assessor’s office to confirm or to find out other important information.

Taxes may be paid annually, twice a year or quarterly. Most of the time when you put less than 20% down the lender will require you to include your taxes and insurance with your mortgage payment. In addition to property taxes, some municipalities also charge a municipal tax or supplemental tax – which is usually a fixed amount that doesn’t change year-to-year.

Down payment:

A down payment is required to purchase real estate. The down payment is subtracted from the purchase price of your home. Your mortgage loan will cover the rest of the price of the home.

The minimum amount you’ll need for your down payment depends on the purchase price of the home you’d like to buy and the type of mortgage.

Most conventional loans will require at least 20% down to obtain favorable terms and avoid private mortgage insurance (PMI) however many borrowers choose to only put 3-5% down in today’s market.

Some lenders offer special programs for buyers, however, which may lower the amount needed for a down payment. FHA loans, for example, may allow buyers to qualify with only 3.5% down if they have a credit score of 580 or higher. Down payment assistance programs may be available for buyers in certain areas who meet income qualifications.

In addition to the down payment, you will also need cash reserves on hand to cover closing costs and repairs that come up during the home inspection process.

Closing Costs:

In addition to a down payment, lenders and third parties associated with the transaction will charge fees to close the loan.

These fees may include loan origination fees, credit report fees, attorney fees, appraisal fees, underwriting fees, etc. In general, borrowers can expect to pay approximately 2-4% of the purchase price in closing costs.

While most of these closing costs must be paid by the borrower, some of them can be paid by the seller, split between buyer and seller or even credited by the lender. It is important that you ask your lender what costs are negotiable and which ones are non-negotiable before making an offer on a home.

Points:

Mortgage points are an upfront loan cost that could save money throughout the life of your loan. Mortgage points can be purchased in order to lower the overall interest rate on your loan. A lower interest rate means lower monthly payments as well as less money being paid over the life of the loan.

The cost of a point is 1% of your total loan amount. For example, if you’re borrowing $500,000 to buy a home, each point will cost you $5,000. Usually every 1% paid to buy the interest rate down equates to .25% in rate.

If you are planning on living your home for a long period of time and expect interest rates to rise, it can be a very wise idea to consider that is also typically a tax-deductible expense, of course consult with your accountant or tax professional the impacts to your taxes when you purchase a home.

Bonus Tips

It is always good to undershoot the number you can most afford. It is better to buy a cheaper house and to have extra money, than it is to overdo it and come up short.

Use a mortgage calculator to determine how much you can afford

Lenders tend to use a formula that is very complex to help decide how much a borrower is able to afford. By using a mortgage calculator you will be able to decide for yourself how much you can afford to pay by factoring in your income, debt, and other expenses to see if you qualify for a home loan.

You can start by calculating your gross income on a monthly basis. Then, you can use a mortgage calculator to determine how much house you can afford.

Here are a couple of sites that offer free calculators: Mortgagecalculator.org or Mortgagecalculator.net

These tools will allow prospective home buyers to get a good estimate as to what their monthly mortgage payments should be.

But be aware that this tool will only be able to give an estimated amount, so it would be wise to speak with a mortgage counselor to get concrete numbers.

Interest rates and guidelines may also vary from lender to lender, so it is always important to first shop around for the best deal before you make your purchase. And in the end, the mortgage lender will have the final say as to how much the monthly payment will be.

If you would like to know exactly how much mortgage you can afford, please call me at 619-379-8999 or email me at [email protected].

by Moe Bedard | Mar 29, 2022 | Mortgage Help |

If you do not have a 20% down payment to purchase the home, you will more than likely be subject to paying private mortgage insurance (PMI), which will be figured into your monthly mortgage payment.

PMI protects the lender in case you default on your loan and don’t have enough equity built up to sell the home and pay off the loan balance. Private mortgage insurers are for-profit companies that provide this protection for lenders.

Private mortgage insurance (PMI) is an extra mortgage cost that is used to cover the risk to a lender, and that is paid by a borrower in monthly premiums tied into their mortgage payments. It is not for the benefit of the borrower.

This type of insurance is usually required by lenders when a mortgage loan amount is above 80% loan to value (LTV) and the borrower has less than a 20% cash stake in the property. A loan amount above 80% is considered a lot riskier to lenders, and in order to cover this risk, they require insurance that will pay them in case the borrower defaults on the loan.

PMI payments range anywhere from 1% to as high as 1.5% of the loan amount that is amortized yearly and paid monthly throughout the life of their loan as long as the loan amount is above 80%.

For example, let’s say you get a $100,000 loan amount and are required to have mortgage insurance. Your estimated monthly insurance payments would be approximately $100 extra a month. A $200,000 loan amount would equate to approximately $200 a month in extra insurance fees.

As you can see, this money can add up quickly. Also, please keep in mind that this money does not help pay down the mortgage balance, and it is not tax-deductible.

You pay PMI as part of your monthly mortgage payment until you reach at least 20 percent equity in your home.

Because PMI exists for the benefit of the lender rather than the borrower, it would make perfect sense that most borrowers would be curious about either avoiding or canceling their PMI policies in order to save money on their monthly payments.

Although it is possible to eliminate the need to pay for PMI, the money required and process can be difficult for many people.

Here are a few ideas on how to avoid private mortgage insurance (PMI).

1. Make a 20% down payment

The most commonly known way to avoid private mortgage insurance altogether is to make a full 20% down payment when closing on your mortgage.

By putting 20% down, the lender knows you are a serious borrower who is placing a good chunk of money as a down-payment and they only have to extend an 80% loan, which makes it considerably less risky. This is also called an 80% loan to value.

Making anything below a 20% down payment automatically binds a borrower to a PMI plan.

However, having 20% down is easier said than done, and many borrowers are unable to meet this demand. This makes this specific method difficult for a lot of people.

2. Get a Second Mortgage

Another way to avoid the PMI policy would be to take on one of these funny-named loans, also known as “80-10-10” or “80-5-15” mortgages. The secret of this loan lies with the fact that it is actually two instead of one.

Although the thought of two separate loans on one mortgage plan might sound scary, they actually reduce the amount that you have to put down on a home while still avoiding PMI. Someone with just enough cash to make a 10% down payment is going to get a 90% mortgage and be stuck with a PMI premium.

Piggyback loans allow home buyers to take on one mortgage for 80% of the purchase price, and a second for 10% of the purchase price.

Under the program, the two loans make one mortgage at 90% of the purchase price, but act as two separate finance options. That 10% down payment under this program will suffice for the 80%-10%-10% plan, and could end up being even lower at 5% for the 80%-5%-15% plan.

Under this option, the 80% loan will not require PMI, and most lenders who hold this plan won’t require PMI under it due to the smaller lower-risk loans. Like everything else, piggybacks come with their downsides.

For example, the interest rate for the second loan will most likely be higher due to such a short term. While paying it off, you may end up paying a little extra in interest, all to save yourself from PMI.

3. Wait for your equity to rise above 20% loan to value

If you are currently paying mortgage insurance, the only way to cancel the insurance is to have more than 20% equity in your property. Some people will need to build equity over time if the housing markets allow them to eliminate their insurance policies. If your homes increase in value so you have 20% equity, then you can have the insurance canceled.

This will not happen automatically.

You have to call your mortgage servicers and have them review your mortgage and home value to assess if you can have the PMI requirement waived.

Important note:

Please keep in mind that mortgage insurance is not an insurance policy to protect you in case you miss your monthly mortgage payments, but for the lender only. If you fall behind on your monthly payments and you have this type of insurance, you can still lose your home to foreclosure.

It is your lender who would benefit from the insurance because they would still be paid in full even if you stopped making mortgage payments altogether and/or if you were foreclosed on.

To see if you’ll be paying PMI, you can start by talking to your loan officer about the details of your loan. They’ll be able to look at the specifics and let you know the amount you will be paying.

by Moe Bedard | Oct 3, 2021 | Mortgage Help |

The CARES Act was designed to help struggling homeowners during the COVID pandemic by offering mortgage forbearance options. Millions of homeowners took advantage and didn’t have to pay their mortgage for three months or longer, depending on the lender.

Now that the forbearance period has ended, many homeowners still need help. If you have a mortgage owned by Freddie Mac or Fannie Mae, you may be eligible for a Flex Loan Modification.

Please keep reading to learn what it’s all about.

How to Get a Flex Loan Modification

Any borrower who is 60 days or more past due on their mortgage or in an imminent default risk may be eligible for the Flex Loan Modification. This new program replaced the previous Home Affordable Modification Program and is only for borrowers with a Freddie Mac or Fannie Mae Loan.

To qualify, you must meet the following:

- You’re experiencing an eligible hardship that affects your ability to pay your mortgage

- You don’t have enough money to cover the mortgage payment and taxes/insurance as it stands

- You have a stable income that allows you to pay the modified mortgage

- You must have originated the mortgage at least 12 months before the request for a loan modification

- You aren’t eligible for a refinance or relief refinance based on your financial situation

- A relief option, such as breaking up the past due amount over a series of months, isn’t feasible

The loan also must not be in the middle of any assistance or recourse, including any workout options, forbearance plans, or active trial plans.

You also must not have modified the mortgage more than 3 times in the past or have failed a past trial period within the last 12 months.

If you’re eligible, you must provide all documentation for a Borrower Response Package, including:

- A completed and signed Uniform Borrower Assistance Form

- Documentation of your hardship

- Proof of income to show that you can afford the loan

Some borrowers may be eligible for a streamlined program if they:

- Are more than 90 days past due and in imminent danger of foreclosure

- Have a step-rate mortgage and become 60 days or more past due within the first 12 months of the interest rate change date

If you’re eligible for a streamlined modification, you don’t have to complete the Borrower Response Package. The lender can modify your loan immediately to avoid the risk of foreclosure.

What Does the Flex Modification Program Offer?

Eligible borrowers may get a more affordable mortgage payment so they aren’t at risk of losing their home.

Lenders have a few options when modifying your mortgage, including:

- Adjusting your interest rate

- Extending your loan term

- Adding the past due amount to the back of the loan and re-amortizing your loan over the new extended term

One final option is setting up a forbearance agreement for part of the loan (usually the amount past due). The lender would then amortize the loan using the current balance without the past due amounts, and the past due amount would become a balloon payment that’s due at the end of the loan. So if you keep the loan for the entire term, your final payment would be the full amount of what is due.

What are the Benefits?

Eligible borrowers experience many benefits with a Flex Modification including:

- Your home loan will be current once you pass the trial period.

- You won’t have to worry about losing your home if you remain current on your new payments.

- Your payments may be as much as 20 percent lower depending on how the lender adjusted your loan.

Do you Need to Apply?

If you are 60 – 90 days behind on your mortgage, you can apply for a Flex Modification if Fannie Mae or Freddie Mac owns your loan.

But, lenders are required to offer the program to any borrower who is 90 days to 105 days past due. So if you are late on your mortgage, you may see this offer from your lender. It won’t tell you the details of the arrangement or what you qualify for, but they will offer you the chance to check your loan and the possibilities to modify it.

By law, if you apply for a modification more than 37 days before your home goes into foreclosure, the foreclosure proceedings must stop. The lender may process your request for a modification, and they start foreclosure proceedings again unless you don’t meet the requirements for a modification.

Passing the Trial Period

All borrowers who get approved for the modification program must go through a trial period. It usually lasts 3 to 4 months. The lender uses this time to make sure you can afford the payments. You must make the payments on time to ‘pass the trial period.’ If you don’t pass, your loan reverts to its original state, and you risk losing your home.

If you make the payments on time, though, the modification replaces your original mortgage and you have a new payment.

Get Help if You’re Struggling

If you’re struggling to make your home loan payments, ask for help. Most lenders are offering the program that has helped millions of borrowers keep their homes while making their loans more affordable.

It’s essential to contact your lender as soon as you know you’re struggling.

Don’t wait and let the home go into foreclosure.

If you wait too long, it could leave you without any options. Discuss your options with your lender, ask as many questions as you need, and figure out the plan to help you keep your home during these trying times.

To get free help online, visit our online mortgage forum at this link.

For those out there who need some housing counseling, please visit the Consumer Financial Protection Bureau’s (CFPB) “Find a Counselor” tool to search for counseling agencies in your area.

Call the HOPE™ Hotline at (888) 995-HOPE (4673) or for other mortgage and financial resources, visit: https://www.consumerfinance.gov/coronavirus/

Or visit HOPE NOW and Neighborhood Assistance Corporation of America (NACA).

by Moe Bedard | Sep 22, 2021

Latest Mortgage News Subscribe to Our Newsletter FollowFollowFollow Demand for Second Homes Declines As Mortgage Rates Rise A new Redfin report says the rush to purchase second homes dropped in February to its lowest level since May 2020. Though demand is still up 35%...

by Erik Sandstrom | Aug 18, 2021 | Mortgage Help |

On July 30, 2021, the Federal Housing Administration (FHA) announced an extension of its moratorium on evictions for foreclosed borrowers and their occupants through September 30, 2021, in response to COVID-19 and the ongoing economic recovery.

FHA’s eviction moratorium extension will also help ease some pressure from lenders who are seeing a rise in delinquencies as rates climb higher.

As part of the COVID-19 Forbearance Plan, Mortgage servicers cannot initiate evictions for FHA Single Family Title II forward, and Home Equity Conversion Mortgage (HECM) foreclosed properties unless they are legally vacant or abandoned.

The initial forbearance period may be up to six months and an additional period of up to six months may be requested by the Borrower for a maximum of 12 months and must be approved by the Mortgagee. The forbearance must not extend beyond June 30, 2022.

“We must continue to do everything within our authority to make sure that foreclosed borrowers who are impacted by the pandemic have the time and resources to secure safe and stable housing, whether it’s in their current homes, or by obtaining alternative housing options,” said Principal Deputy Assistant Secretary for Housing Lopa P. Kolluri.

“We don’t want to see any individuals or families displaced unnecessarily while trying to recover from the pandemic.”

Mortgage servicers may initiate or continue foreclosures following FHA requirements once the moratorium expires.

by Erik Sandstrom | Aug 9, 2021 | Mortgage Help |

The documents required for a mortgage refinance will vary depending on the lender you use. If you stick with your current lender, chances are they still have a lot of your information already on file. However, much of this information will change over the years and will most likely be updated.

It also depends on the lender you apply with and the type of loan you apply for, and understand that with the information you provide, you must also provide all necessary documents to prove that income.

The basic items you will need to refinance are your latest two years of tax returns, six months of bank statements, and pay stubs or proof of income.

Some lenders might require pay stubs over another form of income. With bank statements for various bank accounts, you’ll usually have to obtain the most recent 2-3 months of statements, including the account names, addresses, account numbers, and balances.

Other lenders may even request your diplomas and transcripts and f you are receiving a gift from someone, you must bring a copy of the gift letter.

You will need to know your existing mortgage loan balance for payoffs and payments verification. You can call your lender for an updated statement.

Here is a list of the general items and documents you will need to refinance your mortgage:

– Photo ID and social security number

– Proof of income (copy of paycheck over last 30 days or employer contact info for last 1-2 years). Self-employed borrowers must provide year-to-date profit and loss statements or balance sheets. Pension plans, social security, alimony, and rental property statements also qualify for legitimate income sources

– Tax forms (W-2s and 1099s), are generally required for each loan applicant. Self-employed borrowers must have signed tax returns from the previous 2 years

– Financial records of debts such as student loans, car notes, child support, alimony, insurance, and tax bills

– A homeowner’s insurance policy

– Bank statements for checking accounts, savings accounts, credit union accounts, mutual fund accounts, retirement plans statements, 401K forms, and any other assets

– Statements for mutual funds, bonds, and other securities

– Copy of the deed to your property

– Copy of title insurance

– Loan-to-value appraisal: Most lenders will accept informal appraisals and estimates of relevant figures, but others will require a formal analysis.

– A list of your addresses of residences for the last two years.

– Copy of purchase agreement (If a new construction loan, you may need to provide copies of plans and specifications)

– If you are a resident alien, evidence of permanent residency issued by INS (Green Card)

by Moe Bedard | Sep 11, 2015 |

22 Mortgage Programs to Buy or Refinance a Home Learn about the various mortgage programs for home buyers and existing homeowners. Quick Links Government Help for Home Buyers Government Mortgage Loans Home Affordable Modification Program (HAMP) Home Affordable...

by Moe Bedard | Apr 12, 2022 | Mortgage News from LoanSafe.org |

A new report from Redfin shows that demand for second homes and vacation homes is falling, and they call it an early sign of the housing market slowing down.

The company says that increases in mortgage rates and fees for second home loans are making it more difficult for buyers.

“The pandemic-driven surge in sales of vacation homes is coming to an end as mortgage rates rise at their fastest pace in history, causing some second-home buyers to back off,” Redfin Deputy Chief Economist Taylor Marr said.

“When rates and prices shoot up so much that a vacation home starts to look more like a burden than a good investment and a fun place to bring your family on the weekends, a lot of prospective buyers have second thoughts.”

The slowdown comes after a two year boom in U.S. vacation home purchases that saw an 87 percent increase above pre-pandemic levels in January 2022, according to Redfin.

The Federal Housing Finance Agency also recently announced that it would raise fees charged by Fannie Mae and Freddie Mac on second-home loans.

The fee increase could be an additional will increase between 1.125 percent and 3.875 percent, tiered by loan-to-value ratio. It could add up to $12,000 to a $300,000 mortgage, which is payable upfront or rolled into the loan.

The new pricing takes effect for loans that Fannie or Freddie purchased on or after April 1.

While demand for secondary homes decreased, Redfin said “demand for primary residences outpaced that of second homes for the second month in a row.”

However, they say it’s partly due to the decrease in those buying second homes, since “demand for primary residences” has been about the same since June 2020.

Additionally, the higher mortgage rates are making monthly costs for homebuyers go up sometimes as high as an extra $500 per month, according to Redfin. They say the increasing rates are “driving a sense of urgency to buy before” they go up again, causing potential buyers to back off as their budgets are “exceeded.”

As the housing market remains strained, Daryl Fairweather, Redfin’s Chief Economist, says it may not be all bad.

“Homebuyers may not feel like the market has gotten any easier. That’s because they’re often competing against investors, all-cash buyers and migrants from expensive cities who aren’t as sensitive to mortgage rates,” Fairweather said.

“But there are early indicators that the market is turning, and we expect the softening to become more apparent in the coming weeks, eventually causing home-price growth to slow.”